One conventional explanation for our economic problems seems to be that our businesses are strapped for funds. Greater business earnings, it is said, will translate into needed investment, employment, consumption and, finally, sustained economic recovery. Thus, the preferred policy response: provide business with greater regulatory freedom and relief from high taxes and wages.

It is this view that underpins current business and government support for new corporate tax cuts and trade agreements designed to reduce government regulation of business activity, attacks on unions, and opposition to extending unemployment benefits and increasing the minimum wage.

One problem with this story is that businesses are already swimming in money and they haven’t shown the slightest inclination to use their funds for investment or employment.

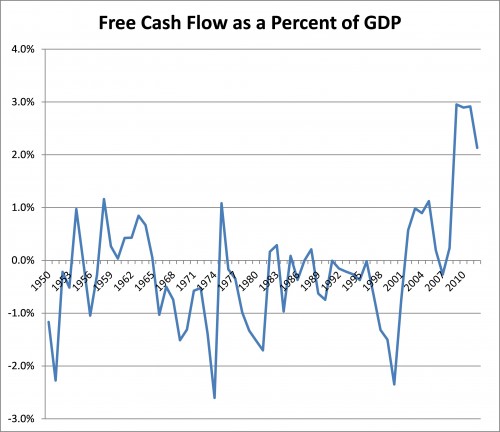

The first chart below highlights the trend in free cash flow as a percentage of GDP. Free cash flow is one way to represent business profits. More specifically, it is a pretax measure of the money firms have after spending on wages and salaries, depreciation charges, amortization of past loans, and new investment. As you can see that ratio remains at historic highs. In short, business is certainly not short of money.

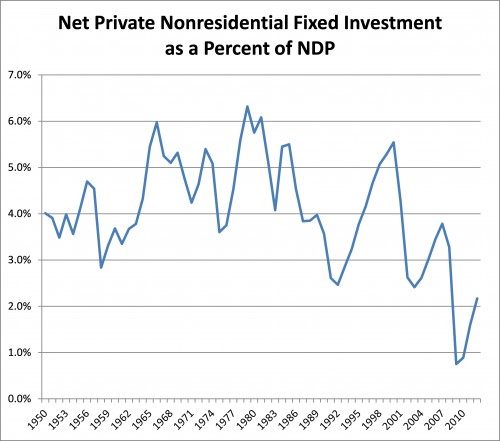

So what are businesses doing with their funds? The next chart looks at the ratio of net private nonresidential fixed investment to net domestic product (I use “net” rather than “gross” variables in order to focus on investment that goes beyond simply replacing worn out plant and equipment). The ratio makes clear that one reason for the large cash flow is that businesses are not committed to new investment. Indeed quite the opposite is true.

Rather than invest in plant and equipment, businesses are primarily using their funds to repurchase their own stocks in order to boost management earnings and ward off hostile take-overs, pay dividends to stockholders, and accumulate large cash and bond holdings.

Cutting taxes, deregulation, attacking unions and slashing social programs will only intensify these very trends. Time for a new understanding of our problems and a very new response to them.

Cross-posted at Reports from the Economic Front.

Martin Hart-Landsberg is a professor of economics at Lewis and Clark College. You can follow him at Reports from the Economic Front.

Comments 19

Phil — January 30, 2014

When businesses use their cash flow to repay shareholders rather than investing in new plant and equipment, it's a signal that they don't believe there are enough opportunities worth investing in. I believe this is partially because our markets are saturated (everything from houses to stuff) already and consumers are tapped out with too much debt.

The other thing to ponder is that these charts are largely a reflection of the situation facing very large corporations. Small businesses collectively employ a lot of people, but individually might have just one or two employees. They are more likely to be the ones without sufficient cashflow to pay higher wages and benefits, and their margins are precarious because they are continually under competitive pressure from the very big players.

pduggie — January 30, 2014

Going Galt.

Bill R — January 30, 2014

Businesses exist to invest against future demand. If they don't see the demand growing, they're not going to invest in something for the hell of it or simply sit on low yielding cash. So they buy back shares to bolster valuations or offer dividends. This is pretty simple.

Remember, it's the shareholders' money in the first place.

Re: lowering or eliminating corporate taxes, two comments.

First, the consumer ends up paying for corporate taxes in the form of higher prices. So when you pull that tax-the-corporations trigger you often shoot yourself in the foot.

Second, higher corporate taxes can backfire when international competitors are operating in a lower tax environment or worse actually subsidized by their governments. Disadvantaging your own business infrastructure isn't exactly a winning strategy in an interconnected world...

James McRitchie — January 30, 2014

This report by M. A. Gumport (http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2258706) expands "into early 2013 studies of the raw performance (profitability) of $457.6 billion of buybacks executed since 2000 by a sample of 232 corporations. The sample companies, drawn mainly from the technology sector, enjoy total equity market value today of $1.221 trillion. 75.0% of sampled companies engaged in buybacks and, in total, paid 38.9% of their current equity market value for buybacks over the past decade.

51.1% of the sampled buyback programs are now profitable. For the group overall, after 13 years, repurchased shares today are worth 13.0% more than their cost. That profit on buybacks equals 5.1% of the group’s current equity value and equates to a 3.7% increase in the group’s stock price before adjustments. After adjustment for foregone interest income net of dividend savings, buybacks since 2000 have provided roughly a 0% benefit to the stock price of the sample group overall; the impact of buybacks on the typical company’s stock price was significantly worse." 0% benefit.

According to Bill Lazonic (http://corpgov.net/2014/01/video-friday-the-myth-of-maximizing-shareholder-value-with-bill-lazonick/), between 2001-2010, 94% of profits of the S&P 500 went to buybacks and dividends. 54% buybacks 40% dividends with 6% left over for building the company. Our vanishing middle class, or probably all but the top 5% depend on that 6% that is invested by companies growing the economy.

disqus_ok9xndxFPu — February 1, 2014

Really a major issue here is the obsession with growth. It's not enough to be profitable enough to pay your investors, pay your costs, provide a good income for your workers, and have a tidy take-home profit. No, whatever you make last year has to be MORE the next year. Everything's about growth, which causes problems when you are producing in a saturated market and you can't grow by expanding your customer base and selling more products.

We as an economy need to accept that some companies should grow, reach a certain point, and stabilize with only minimal fluctuations in their profits. Without the constant rush to sell more, more, more in an economy where that's not necessarily possible, business owners would have a lot easier time being ethical towards their workers, paying their taxes, and still profiting in the end, just the same high profits each year instead of constantly needing to increase them.

Links am Sonntag – 02. Februar 14 | .- — February 2, 2014

[…] “Businesses are Swimming in Money”: More Profit Protection Will Not End the Recession – ” Rather than invest in plant and equipment, businesses are primarily using their funds to repurchase their own stocks in order to boost management earnings and ward off hostile take-overs, pay dividends to stockholders, and accumulate large cash and bond holdings. […]

Tesettur Giyim Trend | Businesses Are Swimming in Money: Profit Protection Will Not Help With Economic Recovery — February 18, 2014

[…] post originally appeared on Sociological Images, a Pacific Standard partner […]

Shad Moon — May 12, 2022

It seems to me that people who have never managed their own company, even a small one, do not understand how difficult it is and how many things need to be taken into account.

Greg Bjorg — May 18, 2022

I would really like to share some useful information with you. The fact is that I found an article in which there is a huge amount of information about how do I delete contacts from my verizon cloud and in fact it was very useful for me. With it, you can synchronize all the information on your smartphone with the storage. However, the application and the website have an interface that many do not understand.

Yen Morante — December 17, 2022

I completely agree! Businesses and investments really. I pondered for a long time how I could use my savings to grow them. I experimented with various ways to make money online, but I discovered that sports betting is my favorite particularly horse racing. I now watch sports events and schedules on the website https://theracingsharks.com.au/racing-tips/.