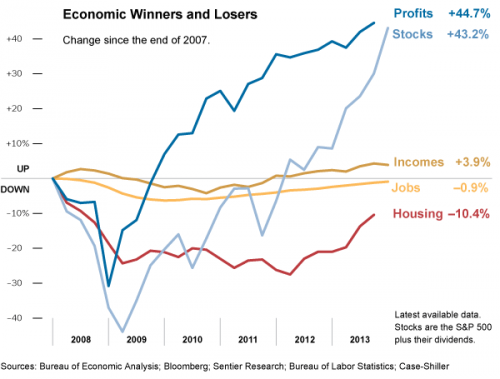

Officially our most recent recession began December 2007 and ended June 2009. The following chart provides an important perspective on the recovery period.

Stocks and profits have enjoyed a remarkable recovery. While income is slightly up over the period, it is critical to remember that this is average income and the increase largely reflects gains for those at the very top of the income distribution. Jobs and housing have yet to recover.

So, with returns to capital booming, it is easy to understand why business leaders are relatively content with current policies and, by extension, political leaders are reluctant to rock the boat.

Unfortunately, current policies are unlikely to do much to improve the job prospects or income of most workers. In fact, the rise in business profits owes much to our depressed labor conditions. Unless something dramatic happens, we can expect the next few years to look very much like the past few years.

Cross-posted at Reports from the Economic Front and Pacific Standard.

Martin Hart-Landsberg is a professor of economics at Lewis and Clark College. You can follow him at Reports from the Economic Front.

Comments 10

#confuzzled — January 18, 2014

Okay, so when profits and stocks plummeted during the recession, that decreased incomes and raised unemployment.

But when profits and stocks went up during the recovery, that neither increased incomes nor raised unemployment.

It might be pretty cool to do an article as to why that happened, because that implies a changing relationship between profits/stocks and income/unemployment that few journalists seem to be covering.

Paulo Renato Soares Terra, PhD — January 18, 2014

All that this picture tells us is that stocks and profits are way more volatile than jobs and income. The former have plummeted much more than the latter during the crises, now it's rising more steeply as well.

Bill R — January 18, 2014

The lack of breadth and understanding in this post, on a board that has the ability to encourage real intellectual thinking, is discouraging. The fact that it's posted on the same day Obama talked of hope for 2014 as a breakthrough year adds to the disappointment.

It's getting hard to ignore the general anti-American, anti-entrepreneurial, anti-capitalism approach we're getting fed here.

My advice is to step it up if you want to remain viable.

[links] Link salad swears by its pretty floral bonnet | jlake.com — January 19, 2014

[…] Whose Economic Recovery Is It? — […]

Darius Lahoutifard — January 19, 2014

EZ! It's very normal because Stocks (and Corporate America's profits) are volatile.

If you want to see something everyone understands better, don't compare the % of growth or decrease of stocks with those of unemployment because they are not comparable. 10% decrease in jobs kills a country, while 10% decrease in stocks happens very regularly.

Divide the scale of stocks/profits by 10 and you'll see all the curves will line up smoothly.

Michael Fryar — January 20, 2014

If it is safe to assume that stock prices are "leading indicators," meaning that the stock market's behavior gives a preview of what will happen in the rest of the economy, then we should not extrapolate from this picture and assume "the next few years [will] look very much like the past few years." Instead, a stock market recovery bodes well for the other indicators. It is possible, however, that we are at a "new normal" and jobs will not rebound to previous levels.

Tesettur Giyim Trend | Dismal Trends: Whose Economic Recovery Is It? — February 4, 2014

[…] post originally appeared on Sociological Images, a Pacific Standard partner […]

Ungleichhheit und die Macht der Ideologie | sunflower22a — March 5, 2014

[…] meine Lieblings-Soziologin Lisa Wade untermauert auf ihrem Blog mit ihren illustrativen Grafiken diese These. Was ist eine Rezession und was ist ein Aufschwung? Ist es ein Aufschwung, wenn die […]

Dismal Trends: Whose Economic Recovery Is It? - Pacific Standard: The Science of Society — March 25, 2014

[…] post originally appeared on Sociological Images, a Pacific Standard partner […]