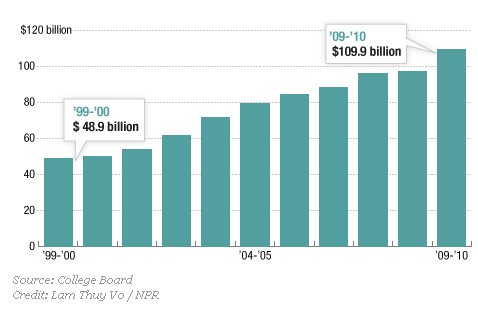

You’ve probably heard someone in media or politics bemoan the ballooning student debt in the U.S. In fact, debt has been rising. It’s more than doubled in the last ten years (that’s a more than 100% increase):

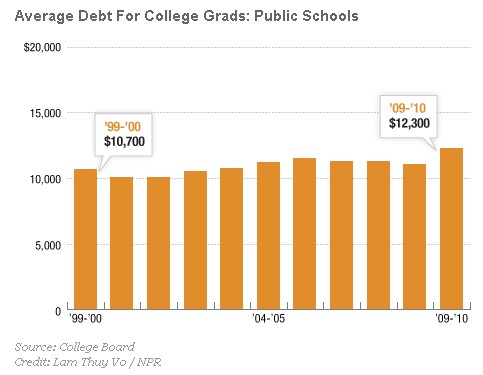

This debt, though, can’t be attributed primarily to the rising cost of education, as Planet Money explains. The average debt load for a student graduating from a public school, for example, has risen by 20%:

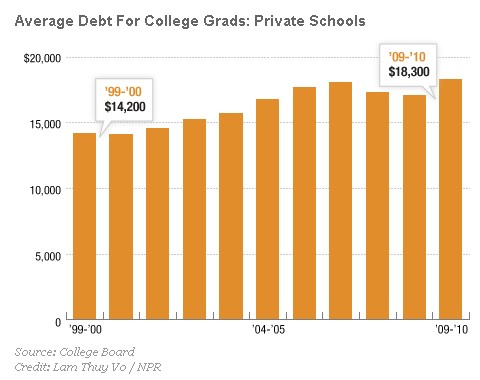

The average debt load for a student coming out of a private school has gone up a bit more, but still not enough to account for the leap in overall student debt.

The increase in debt, it turns out, is largely accounted for by an increase in the number of people going to college. In 1970, 8,500 8,500,000 people enrolled in college in the Fall; in 2009, that number exceeded 20,000 20,000,000 (source). A more than 100% increase.

So, the story isn’t quite as dire as we might think. This may be little consolation, though, for my students who walked across the stage yesterday. Congrats, Seniors! :)

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 36

Swandive6 — May 21, 2012

Might want to make clear that those numbers are in thousands: 8.5 million people enrolled in fall of 1970 and more than 20.4 million in fall of 2009.

Alison — May 21, 2012

It seems like those 1970 vs 2009 statistics should be times a thousand.

Al Mond — May 21, 2012

An increasing number of people attending college might explain the conclusions of the Rutgers study (well, that and the recession I guess). Perhaps, the more people have a degree, the less that degree is likely to assure them a stable and well paid employement. What doesn't make sense is that the costs of education are getting higher. The price of education should follow what education can give to somone.

MPS17 — May 21, 2012

Nice post; thank you.

Reporting on higher education is highly problematic, for one because the system is changing in many ways at once, as you indicate. But perhaps more importantly, it's a complicated system without any clear norms.

That is, when people talk about "higher education" in America, they are talking about Harvard University and University of Massachusetts and Oberlin College and Cleveland State University and Devry University and California State University LA and Brandeis University and University of Montana and the University of Phoenix and the US Naval Academy and so on.

Few discussions of global trends in higher education take account of this diversity. It's also a competitive system: institutions compete not only with peers to attract top students and faculty and financing, but, at the margin, they compete with very different types of institutions (i.e. research universities with four-year colleges with community colleges, private non-profit with state with for-profit, etc.). So it doesn't make sense to use language or concepts that tacitly assume some centralized decision-making control. Trends that are common to all of higher education speak to broad changes in society, and responses to them.

Failure to acknowledge these points makes me think that much editorialism on the subject is really about culture war -- reducing the status of academics and/or education credentials and/or the directions of modern academic inquiry -- than about making progress.

Anonymous — May 21, 2012

This is so hard to believe... I graduated 3 years ago; during my time at a private college tuition went up about 6-10% every year. Friends at UC schools had their tuition go up 32% in 200...9 I believe? And then 10% every semester from then on.

Is it that college was too cheap for too long and now it's approaching its actual value? That seems hard to believe as a degree means much less than it used to, perhaps because so many people have them now.

Maybe it's a free market response to too many people getting degrees - it gets more expensive, thus shutting more people out... I guess a degree is only meaningful if it's scarce, like any other commodity. It's just weird, because usually when something's value decreases, its price decreases, not the other way around.

This way seems like some kind of strange social engineering. Feels like it's not economics, it's a way to keep poor people from getting educated thus competing for higher paying jobs, thus keeping them middle/lower class or something. That's hard to believe (who is this shadowy figure controlling education prices as a means for class warfare?), but...

I don't know. It's just weird.

Mckaa302 — May 21, 2012

Your statistics, as other people noted, are incorrect.

Likewise, they don't add up to what you state above. It says within the last decade it has risen 100%; yet, the amount of students rising is over the last FOUR decades. What did it rise in the last decade.

This is misleading. I think most likely it is a combination of these things and not just one factor. Because none of these things, including the rise in students in college as you posit, could account for it alone based on your own statistics.

bamboo_princess — May 21, 2012

Yeah this isn't a great comparison. You're graphs look at 1999 vs the present and your last number given is 1970 to the present. To compare apples to apples:

In 2000 15,312 students enrolled in college compared to 20,428 in 2009. That's a 25% increase. So if debt has doubled in the last ten years but student loan population has increased by only a quarter, quick assumptions would place rising costs as responsible for half of the loan increase.

As others have mentioned there are a lot of variables to take into account. Types of schools being a major one. I'd be curious to know about the rise of for-profit colleges and how they correlate.

Brettleb — May 21, 2012

If you look at constant dollars, then the levels look like they remain fairly flat overall on a per borrower basis. That's not too bad given costs have rapidly increased.

http://completionagenda.collegeboard.org/recommendations/7?quicktabs_1=1&indicator=79

serval — May 21, 2012

I don't even understand the reasoning... why would more people enrolling in college increase the average college debt? Can someone explain this to me? (and yes, the comparisons are off given 1970 vs 2010 numbers)

Thomas Gokey — May 21, 2012

Maybe I'm misunderstanding the post and chart, but collective student debt is now over 1 trillion dollars with a T, not 100 billion.

We're organizing a student debt refusal.

Tom — May 21, 2012

I have to echo some of the other comments here. There is a lot wrong with this post and it needs to be re-written.

Kakkuonhyvaa — May 22, 2012

U.S.A U.S.A!

STUDENT LOAN DEBT NOW EXCEEDS 100 BILLION. WHY? « Welcome to the Doctor's Office — May 22, 2012

[...] from Soc Images [...]

Student Loan Debt Now Exceeds 100 Billion. Why? | Environmental, Health and Safety News — May 22, 2012

[...] and rising. Why? doubled in the last ten years (more than 100% increase) http://t.co/FgDq0qEx Link – Trackbacks Search for EHS News Search [...]

Zachary C — May 24, 2012

How Student Loan Consolidation Works

Military Debt

Management Agency works with the Department of Education to help consolidate

your Federal Student Loans. Our Certified Financial Counselors will review your

student loans and determine which loans are applicable to be consolidated based

on the Department of Education's guidelines. Generally, your payment is about

50% less than your current minimum payment with a decrease of the interest rate

between 1-6%. Once our counselors determine your eligibility and approximate

payment, they will gather all the necessary information needed for the

consolidation and send out all agreements and forms for your signature. From there

our underwriting department will review your file and send it to Department of

Education for final approval. From there the Department of Education will

approve the consolidation, sending you a new promissory note to be signed and

sent back and then your consolidation is done, and you'll begin making payments

at the lower amount. It's that easy.

Student

Loan Forgiveness Program

What is the

Public Service Loan Forgiveness program?

Through the College Cost Reduction and Access Act of 2007, Congress created the

Public Service Loan Forgiveness Program to encourage individuals to enter and

continue to work full-time in public service jobs. Under this program,

borrowers may qualify for forgiveness of the remaining balance due on their

eligible federal student loans after they have made 120 payments on those loans

under certain repayment plans while employed full time be certain public

service employers

What

types of public service jobs will qualify for loan forgiveness?

A federal, state, local, or tribal government organization,

agency, or entity(includes most public schools, colleges and universities)

A public or family service agency

A non-profit organization under section 501(C)(3) of

the Internal revenue Code that is exempt from taxation under 501(a) of the

Internal Revenue Code (includes most non-profit private schools, colleges,

and universities); A Tribal college or university; or A organization that

is not a for-profit business, a labor union, a partisan political

organization, or an organization engaged in religious activities

Emergency Management

Military

Law Enforcement

Public interest law services

Early Childhood Education (including licensed or

regulated health care, Head Start, and state-funded pre-kindergarten)

Public Service for individuals with disabilities and

the elderly

Public health (including nurses, nurse practitioners,

nurses in a clinical setting, and full-time professionals engaged in

health care practitioner occupations and health care support occupations)

Public Education

Public library services; and School library or other

school based services.

Zachary

Crayon

Senior Financial Counselor

Military Debt Management Agency,

Inc

3773 NW 126th Avenue, Suite 3

Coral Springs, FL 33065

zcrayon@MilitaryDebt.org

www.militarydebt.org

T (800) 323-3343 x565

F (954)628-5297

Captain Pasty — May 27, 2012

In New Zealand something similar is happening. Tertiary education used to be free until about 1989, then cost around $100 a year. Now I am paying $8,000 a year. My loan is around $40,000 and I've only just started my postgrad (because I couldn't get a job with my undergrad). The current student debt is $12billion (for a country with a population of 4 million)

In the meantime, the prime minister (John Key the multi-millionaire) are increasing the repayments to 12% if you earn over $19,000 a year (that's below the poverty line mind you). Also, there are cutbacks to those allowed student allowance, meaning that some people are cut off halfway through their studies. And all this means that it's even harder for poor people to get higher education, so it's harder to get out of the poverty cycle.

As well as this, he's selling huge state assets, kicking poor people out of their houses, increasing tax on children who have after-school jobs, all while giving $2billion of tax cuts to the top 10% of earners in New Zealand.

Russell Benson — January 31, 2023

Thank you for this information and article!

Ross Henderson — January 31, 2023

Hello, I would want to offer my knowledge. As a student, I have an immediate need for money. Regarding the financial systems, I am unable to obtain funds from the bank. Applying to a business that may provide me with a loan proved to be an excellent answer for me. I did a lot of reading on whether this choice was wise. I wish to share a lot of the important information I discovered with you. I read about the apps that loan money, and it got me interested in the study of finance. You should read it as well, in my opinion.

YaMal1 — March 16, 2025

Student loan debt is overwhelming, and I’ve seen more people turning to crowdfunding just to stay afloat. A friend set up a GoFundMe to help with tuition, but for some reason, donations weren’t processing correctly. The page showed payments as "pending" for days, and there was no clear explanation. Had to reach out to gofundme customer service to figure it out. After some back and forth, they finally fixed the issue. Crowdfunding is a great option, but when problems pop up, getting answers shouldn’t take so long!