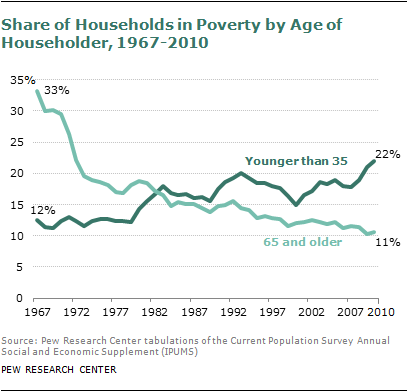

Amy H. sent in a link to a Pew Research Center report on age and economic well-being in the U.S. The results indicate that over time, the economic situation has generally improved for older individuals in the U.S. Those over age 65 are much less likely to be poor today than they were a few decades ago, for instance:

Why the dramatic reduction beginning in the late 1960s? One important factor is the role of public policy. In 1965, the U.S. passed legislation establishing Medicare, which greatly increased access to medical care for the elderly regardless of income. Medical costs had previously been a major drain on savings; a significant illness could quickly eliminate a lifetime’s savings. Medicare reduced the risk posed by medical expenses and the percent of income spent on health care among the elderly.

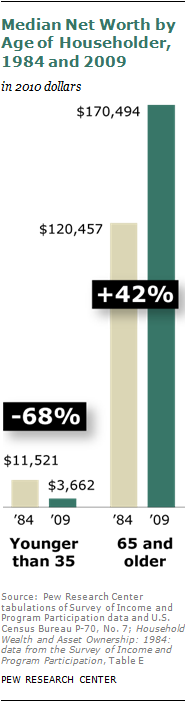

Today, retirement-age Americans have significantly higher net worth than those under age 35, and the gap has widened since the 1980s. The younger age group actually lost ground, with a lower median net worth in 2009 than in 1984:

Of course, we expect individuals to become better off economically over time as they settle into jobs, save for retirement, perhaps pay off a home so that housing expenses go down. But the improving economic well-being of older Americans isn’t just a natural outcome of the lifecourse; it reflects changing public policies that have over time increasingly allowed the elderly to access medical care and other services without impoverishing themselves in the process.

Comments 3

Yrro Simyarin — February 1, 2012

And apparently impoverished young people at their expense. But that's what happens when more than a third of the budget is wealth transfer to a single demographic. Not that I'm in favor of old people starving in the streets, but we've gone far beyond that.

Economic Well-Being Among Older Americans; Why the Real Housewives of Atlanta Aren’t “Our Kind of People” « Welcome to the Doctor's Office — February 1, 2012

[...] ECONOMIC WELL-BEING AMONG OLDER AMERICANS by Gwen Sharp, [...]

Guest — February 1, 2012

... and in a recession, it seems like older Americans are holding onto their jobs. Plus, increased life expectancy means that fewer Americans are retiring at 65.

Both of these trends mean that upper-level, upper-mid-level, and (increasingly) mid-level jobs are not being opened up at the rates at which college graduates are entering the job market.

The baby boom generation collided with a recession, and one outcome is that the not-yet-employed were hit harder by baby boomers' (completely reasonable) desire not to have themselves (individually) get hit by the negative outcomes of the recession.

Add to this the justification of "I paid into the system, they are leeches" (without actually recognizing that it's impossible to pay into a system that doesn't allow you into it to pay into it in the first place). True, boomers have done a lot to build the economy. However, they are also structurally doing a lot to hinder the following generations' ability to do what they were able to do when they were starting in their jobs (starting with having jobs).