Originally posted at Organizations, Occupations and Work.

Last week I discussed the connection between the Occupy Wall Street protests and the long-term transfer of national income into the finance sector. Well the problem is worse than Wall Street’s power over the national economy and polity.

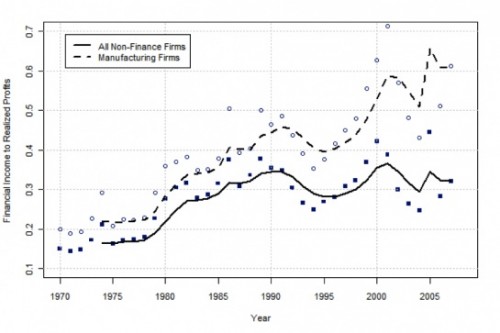

There really are two faces to financialization. The most familiar face is the dominance of the finance sector over the rest of us: the giant profits and bonuses at the big banks and investment houses and the instability generated by too big to fail but rapaciously imprudent financial services firms. The other face is the financialization of the rest of the economy. Greta Krippner figured this out first. Greta discovered that since the 1980s firms in the non-finance sector have increasingly invested, not in the production of goods and services, but in financial instruments. The productive economy, Main Street in some formulations, has increasingly abandoned production in favor of financial shenanigans. Finance related income, including interest, foreign exchange profits, and stock market investments have risen from about 1/8th of corporate profits to around 30%. In the manufacturing sector the move from production to financial strategies has been even more dramatic, rising to a ratio of finance revenue/profit as high as .60 after 2000.

The most well-known examples of this type of financialization might be the financial arms of automobile manufacturers. General Motors established its financial arm General Motors Acceptance Corporation (GMAC) in 1919 and Ford established its financial service provider Ford Motor Credit in 1959. Before the 1980s, the main function of these financial institutions was to provide their automotive customers access to credit to increase car sales. Starting in the 1980s, these firms broadened their portfolio. GMAC entered mortgage lending in 1985. In the same year, Ford purchased First Nationwide Financial Corporation, the first thrift that operated at the national level, to enter the savings and residential loan markets. In the 1990s both GMAC and Ford Motor Credit expanded their services to include insurance, banking, and commercial finance. In 2004, GM reported that 66 percent of its $1.3 billion quarterly profits came from GMAC; while a day earlier, Ford reported a loss in its automotive operation but $1.17 billion in net income, mostly from its financing operation.

Founded in 1943 GE Capital was designed to provide loans for the customers of home appliances. However, under the post-1980 leadership of Jack Welch, its scope rapidly expanded to small business, real estate, mortgage lending, credit cards, and insurance. After running a close second for more than two decades, it topped GMAC as the largest nonbank lender in 1992. The profit return to financial expansion was extraordinary. In retrospect this should not be surprising; the same financial deregulation than broke down the walls between various types of financial firms also freed non-financial firms to enter these markets. Simultaneously deregulation created fertile fields in which to capture income in multiple financial markets.

This kind of financialization is in many ways more insidious than the concentration of wealth and power on Wall Street. At this point many of us, including political movements such as Occupy Wall Street and even the Tea Party movement can see that financial power and concentrated wealth undermine democracy and capitalism respectively. I think that the financialization of the non-finance sector has undermined the real economy by reducing capital and management commitment to production and further marginalizing labor’s role in U.S. corporations. The result has been an incremental exclusion of the general workforce from revenue generating and compensation setting processes. While once CEOs were celebrated for expanding employment and market share, they are now lauded for increased profitability and decreased employment. They have accomplished this transition by shifting the creative energies and investment strategies of their firms away from the production of goods and services and into financial investments.

Recently Ken-Hou Lin and I have found that as financial strategies replace production ones, income inequality climbs dramatically. In fact as industry financialization rises so does capital’s share of income. In addition, financialization is associated with higher compensation for corporate officers and higher income inequality among employees. We estimate that about half of the post 1970s decline in labor’s share of income, 10 percent of the growth in officers’ share of compensation, and 15 percent of the growth in earnings dispersion between 1970 and 2008 are linked to the financialization of the non-finance sector. One way to think about financialization is that it is a system of income redistribution which strengthens the hand of finance capital and weakens the hand of labor associated with the real economy.

Comments 57

Weiwen Ng — November 11, 2011

This has been one of my big concerns with the way our economy is structured: I think our economy is over-financialized. I agree this has led directly to income and wealth inequality.

In addition, I would point out that the financial industry has taken a lot of our best minds - those folks could be helping make health care more efficient, or improving urban planning, or analyzing environmental impacts, or helping whatever small, medium or Fortune 500 company run better.

Instead, they're going to Wall Street and trading the same damn pieces of paper back and forth millions of times a day. They're earning money, but not adding real value to society imo. And I think more objectively, they're making our economy more volatile - i.e. things blow up more often.

I will say: there are a lot of financial innovations that are beneficial. Commodities futures enable producers, like farmers and oil and gas manufacturers, to make their future earnings more stable (by locking prices in, in case they fall precipitously). Mutual funds provide a flexible and low cost structure for even individual investors to save for their future. Insurance protects our savings from catastrophic events - life, auto, health and long-term care insurance are all financial innovations. So are ATMs and debit and credit cards, that make it easy for us to get at our money. 30-year fixed rate mortgages enable us to buy houses at a predictable, manageable monthly payment.

However, we've put too much of our social and intellectual capital into finance. In return, it's given us a lot of dodgy financial innovations, including some that nearly blew the entire economy up.

How the upper and middle classes embraced a culture of household debt and aggressive financial risk taking | Work in Progress — July 15, 2015

[…] three decades represents one of the most remarkable trends in the recent history of capitalism. “Financialization” has become a common byword to describe the growing role of financial markets, motives, actors, and […]

Financialization: Why the Financial Sector Now Rules the Global Economy – NewsWars — March 18, 2020

[…] Perhaps the most commonly given example of financialization is the expansion of the financial arms of US automobile manufacturers: […]

Financialization: Why the Financial Sector Now Rules the Global Economy - Lente Conservador — March 18, 2020

[…] Perhaps the most commonly given example of financialization is the expansion of the financial arms of US automobile manufacturers: […]

Financialization: Why The Financial Sector Now Rules The Global Economy – OpEd | Bitcoin World Report — March 18, 2020

[…] Maybe probably the most generally given instance of financialization is the expansion of the financial arms of US automobile manufacturers: […]

Why the Financial Sector Now Rules the Global Economy – New Liberty News — March 18, 2020

[…] Perhaps the most commonly given example of financialization is the expansion of the financial arms of US automobile manufacturers: […]

Financialization: Why The Financial Sector Now Rules The Global Economy – OpEd – Premium Financial Daily — March 18, 2020

[…] Maybe probably the most generally given instance of financialization is the expansion of the financial arms of US automobile manufacturers: […]

Financialization: Why the Financial Sector Now Rules the Global Economy snbchf.com — March 19, 2020

[…] Perhaps the most commonly given example of financialization is the expansion of the financial arms of US automobile manufacturers: […]

Financialization: Why the Financial Sector Now Rules the Global Economy – Finance Market House — March 19, 2020

[…] Perhaps the most commonly given example of financialization is the expansion of the financial arms of US automobile manufacturers: […]

Financialization: Why the Financial Sector Now Rules the Global Economy | Share Market Pro — March 19, 2020

[…] Perhaps the most commonly given example of financialization is the expansion of the financial arms of US automobile manufacturers: […]

WillWilliam009 — January 9, 2023

Hi guys. I am currently looking for such information. The thing is, I want to make money online. I am most interested in cryptocurrency trading. I heard it's very popular now. If you have such information, please share it with me. Thanks in advance.

Benjamin Poirot — January 10, 2023

Interesting. Your post got me interested in cryptocurrencies. A friend told me that trading is very profitable and even suggested reading this article to learn more about it https://tabtrader.com/articles/what-is-an-eclipse-attak. Now I know that many people make money online with cryptocurrencies.

samibaceri — January 16, 2023

I've always dreamed of making a lot of money. It annoys me that there are so few good jobs in my city. All jobs are low paying. That's why I decided to trade. It doesn't take long, and by working with a trusted broker like https://topbrokers.com/forex-brokers , I'm confident that everything will be fine with my money. This is my chance to live better.

Maximilian_Hohenzollern — February 28, 2023

I think that adding real value to society is important, but people need to worry about themselves first. Otherwise, their financial situation may go downhill, and that's it. Personally, I've been trading stocks for a while with https://www.koyfin.com/compare/yahoo-finance-alternative/ , and I can say that profit is the main reason I do that, and I'm pretty sure that for the most people, it's their major priority as well.

Anna Burke — July 20, 2023

Financialization has significantly contributed to income inequality. As wealth becomes increasingly concentrated in the hands of a few, OWNR Wallet offers a solution for individuals seeking to diversify their income and take control of their finances. OWNR is a secure virtual wallet app designed to streamline cryptocurrency experiences. It provides a reliable tool for daily operations and offers the cheapest way to buy Bitcoin. With support for 9 coins, ERC-20 tokens management, and real-time BTC price tracking, OWNR empowers users to participate in the crypto economy. Take charge of your financial future with OWNR Wallet: https://ownrwallet.com/

Viktor low — July 20, 2023

Financialization has significantly contributed to income inequality. As wealth becomes increasingly concentrated in the hands of a few, OWNR Wallet offers a solution for individuals seeking to diversify their income and take control of their finances. OWNR is a secure virtual wallet app designed to streamline cryptocurrency experiences. It provides a reliable tool for daily operations and offers the cheapest way to buy Bitcoin. With support for 9 coins, ERC-20 tokens management, and real-time BTC price tracking, OWNR empowers users to participate in the crypto economy. Take charge of your financial future with OWNR Wallet: https://ownrwallet.com/ 🚀💰

Striking Autoworkers Will Only Harm Their Own Livelihoods – Mars Retirement — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – The Investment Vault — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Keep Resignation Safe — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Day Trading Reports — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Your Investings Foundation — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods - Daily Invest Pro — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Top Stocks Insider — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods - Global News Updates — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Investment Wave Updates — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – WallStreetJedi — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Right Decision Now — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Best Retirement Wishes — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Invest People Report — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – InvestingsDontLie — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Privacy Invest Pro — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Investing Times News — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Bear Market Leader — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Effective Stock Habbits — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods - The American Dream Report — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Smart Investing Reports — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods | Connor O’Keeffe – World Law Reporter — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Success American Investors — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Chillout Age — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Your Investing Chance — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Bullish Stock Trader — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Jay Taylor Media — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Golden Stock Insiders — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Major Trade Flow – Investing and Stock News — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – Protect Your Stock — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – WebinarExpertTeam.com — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – TheVoiceOfThoughts.com — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods | New Covenant Network News — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – HorizonLifeTime.com — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – FinancialSourceReport.com — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – BasicTradingTips.com — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – ContributionAmericans.com — September 20, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – iftttwall — September 23, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods - The Daily Conservative Report — September 23, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods – 67x.info — September 23, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]

Striking Autoworkers Will Only Harm Their Own Livelihoods | ZeroHedge — September 23, 2023

[…] low savings, and hyperfinancialization—all at the same time. In fact, one of the most notable examples of the financialization of the economy since the 1970s has been the growth of the Big Three […]