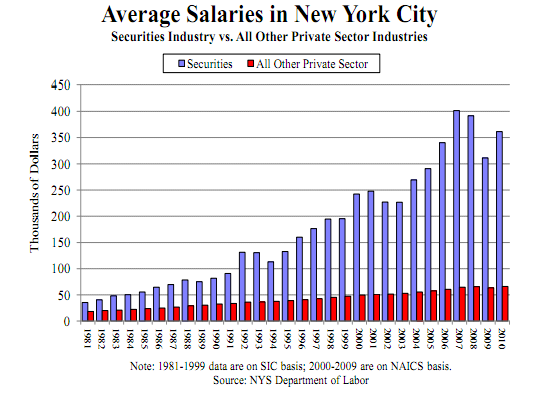

Graphic Sociology linked to a study by the Office of the State Comptroller aiming at understanding the importance of the securities industry to New York City’s economy. It reveals something we already know quite well — that compensation to financial services sector workers is extraordinarily high (~350,000/year) — but also that the relative compensation of financial services sector workers, compared to the average worker in New York City, has increasingly advantaged the former.

This figure, included in the report, shows just how disproportionately compensation in the finance sector has been growing compared to compensation for everyone else. While workers in other private sectors have seen their incomes about triple since 1981, workers in securities are making, on average, eight to ten times what they were making 30 years ago. This means that, while people in finance made about twice what the average worker made in 1981, they now make about six times the income of the average private sector worker.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 7

pduggie — October 19, 2011

is there a chart that tracks profitability of finance companies relative to the profitability of other industries and compares compensation based on that?

What if security companies are also, on average, proportionately more profitable than other industries?

anku singh — October 22, 2011

They generally regard financial markets that function for

the financial system as an efficient mechanism. In practice, however, emerging

research is demonstrating that such assumptions are unreliable. Instead,

financial markets are subject to human error and emotion .New research

discloses the mischaracterization of investment safety and measures of

financial products and markets so complex that their effects, especially under

conditions of uncertainty, are impossible to predict. Here i introduce a new

Follow/Subscribe to #marketing @ RonOrr.com

site which gives us a lot of

information.

Guest — October 31, 2011

Perhaps this is alluding to an oft-underrepresented actuality: that workers in the securities industry are often many times smarter than those of other private-sector industries.

Rick Flint — October 20, 2021

I'm pretty sure that even today, people working in finance make way more money than average workers. That's why I believe that everyone should invest in order to raise their income. For example, I chose to work with Crypto Trader and invest in cryptocurrency, and according to the latest news, it was pretty profitable.

Ladier Lydie — October 10, 2022

Interesting. Your message made me interested in cryptocurrencies. A friend told me that trading is very profitable, and he even suggested a crypto trading platform, but I was not sure that it was popular. But now I know that many people make money on the Internet using cryptocurrency.

plassens — February 5, 2023

If you are interested in trading crypto, you may want to check out a crypto trading app. This is a great way to get involved in the crypto market and earn commissions on your trades. There are many apps available, but each one will have its own unique features. Choosing the right one is an important step to building your portfolio.

Osborn Tyler — March 7, 2023

market maker crypto is a firm or individual that buys and sells cryptocurrencies through an exchange to provide liquidity and depth while earning profits through the difference between the bid-ask spread.

Market makers play a vital role in the crypto and decentralized finance (DeFi) ecosystems, helping token issuers increase market cap, drive high organic trading volumes, and make it easier for new projects to get off the ground.