Cross-posted at Reports from the Economic Front.

Austerity advocates talk about government spending as if its impact on the economy is marginal. In their world, we can slash spending with few if any consequences for our roads and bridges; transportation, health care, and educational systems; research and development activity; investment in plant and equipment; employment and wage levels; economic growth . . . the list goes on.

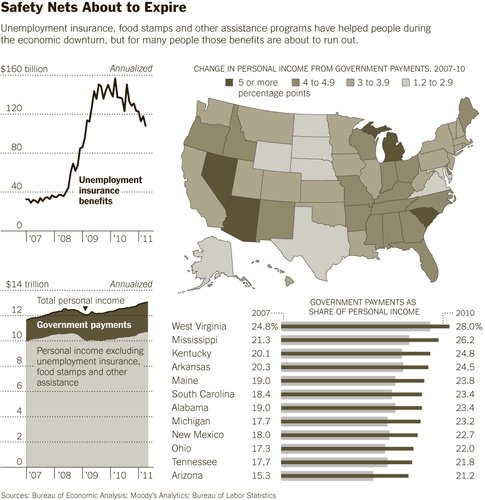

That may be how it looks in their world, but in the real world it is quite different. Looking just at personal income, for example, the New York Times reports that:

An extraordinary amount of personal income is coming directly from the government.

Close to $2 of every $10 that went into Americans’ wallets last year [2010] were payments like jobless benefits, food stamps, Social Security and disability, according to an analysis by Moody’s Analytics. In states hit hard by the downturn, like Arizona, Florida, Michigan and Ohio, residents derived even more of their income from the government.

If the austerity advocates have their way, public spending will be cut. However, as the information in the box below reveals, the consequences will be severe for our entire economy, not just for those individuals directly receiving support. As the New York Times explains, “Throughout the recession and its aftermath, government benefits have helped keep money in people’s wallets and, in turn, circulating among businesses. Total government payments rose to $2.3 trillion in 2010, from $1.7 trillion in 2007, an increase of about 35 percent.”

We definitely need to remake our political-economy. However, it is madness to think that destroying the social infrastructure underpinning current economic activity is a productive way to achieve that goal.

Comments 10

Anonymous — July 25, 2011

It's become a pretty black and white political issue. Either you're a liberal and you believe the government can help people and create a more fair economy that benefits everyone or you're a conservative and think it's inherently corrupt and stifles the potential of the free market. What seem's to really be going on is cronyism between the government and corporations that is full blown class warfare.

gasstationwithoutpumps — July 25, 2011

That map is a highly misleading one, as it shows CHANGE in government support (and it is not clear what denominator was used for the %). What people expect to see on such a map is what the fragment of a bar graph shows: what fraction of personal income comes from government support.

It is also no clear what programs were included in the assistance programs: does it include tax breaks for mortgages, for example, or only direct assistance like unemployment? Does it include government pensions other than Social Security? Does it include medical benefits like the Veteran's Administration?

The picture is so vague that it looks entirely crafted for some political purpose: to manipulate rather than to inform.

Yrro Simyarin — July 25, 2011

The question is not whether reducing government spending will hurt the economy. The question is whether continuing to borrow nearly 50% of our spending will hurt it worse. Whatever the correct solution, we can't spend money we don't have forever. Taxing the rich at 100% isn't even enough to make up the gap.

Government spending massively increased in the last decade. By all parties, for all purposes - defense, medical, education - everything. If state spending, at least, had only grown with inflation relative to 90's levels we wouldn't have this problem. We have to come up with a solution at some point, and the longer we wait the rougher it is going to be.