The “poverty line” is an income, set by the federal government, used to measure whether one is in or out of poverty. But this line, of course, is both sociological and political. What is poverty?

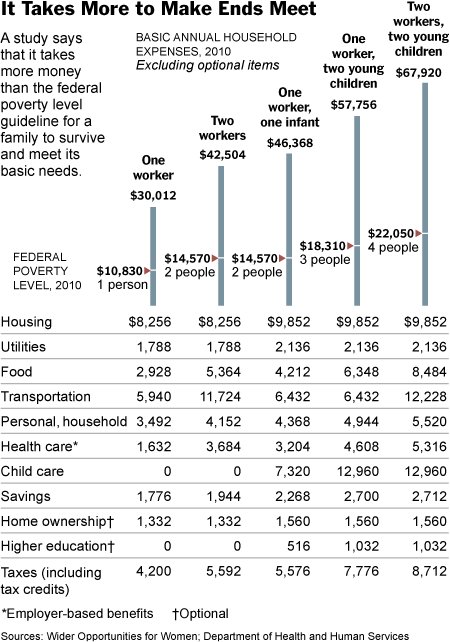

A nonprofit organization called Wider Opportunities for Women has released a study challenging the federal poverty lines. According to the New York Times article on their work, their aim is to “…set thresholds for economic stability rather than mere survival, and takes into account saving for retirement and emergencies.” Their “lines,” then, deviate significantly from those of the federal government.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 47

Marc — April 13, 2011

Unless there is a policy goal behind it, making up a list of things it would be nice to have the money for isn't very interesting. The levels indicated in the chart above would (I am guessing here) get you well into the 2nd quintile of households in the US. A lot of people below the levels here are getting by just fine thankyouverymuch, and they do so by consuming a very different basket of goods. They rely on extended family for things, they share space, ride bikes, they coupon extremely, etc etc.

In grad school I lived on less than the single household figure in the Boston Metro area (very expensive), I had money to ski and buy myself toys and my rent and utilities were about what is listed there. So I smell a rat.

I am one of 5 siblings, and I grew up getting babysat by old ladies from down the street, who I am quite sure were paid less than minimum wage by my parents. Point is, when you haven't got all that much money, you find ways to get by that may or may not meet up with what a poverty advocate says, who has every reason to inflate figures and make people appear to be worse off than they are. When the number is this astronomical, it makes it hard to take the analysis seriously.

malta — April 13, 2011

The most interesting thing to me about the poverty lines is the history behind how they were set. In 1963, Mollie Orshansky at the Social Security Administration came up with the methodology of setting a line based on a family spending 33% of its income on the USDA's thrifty food plan. It's been indexed for inflation, but hasn't changed otherwise since then.

So you can do the math today to see the poverty line still assumes families spend 1/3 of their income on food. For example, the thrifty food plan for a family of four costs $600/mon. Multiply that out to be 1/3 of their income and you get a poverty line of $21,600 per year.

$600/mon x 12 mon x 3 = $21,600

This organization's research is valuable because it shows that we really shouldn't be using a line calculated based on food prices because the mixture of expenses has changed greatly since the 1960s. Food costs have gone done (so they're now more like 8% of total household expenses), while housing and energy costs have gone up. All of which is just a long comment to say that the current poverty lines really do need to be updated.

Source: http://aspe.hhs.gov/poverty/papers/hptgssiv.htm

Chris — April 13, 2011

Wow, there is health care listed on here. Is that premiums or deductables? Or is that what the company pays? What if people don't qualify for company benifits? Is state or federal healthcare cheaper?

We are two parents, two kids in Canada who are below both lines: poverty and security. And boy are we upset that we have to pay $450 a year for our whole family out-of-pocket for healthcare (prescriptions and supplies). Doctors, ER, surgery is of course all free.

Bob — April 13, 2011

I agree with Marc: these numbers are well above stable basic living.

As a single grad student my stipend was well below the "stability" threshold (about double the poverty line) and I keep meticulous track of where all my money is spent.

The big items in 2007 were:

Rent: $7,196

Transportation: $1,341

Utilities: $1,214

Charitable donations: $1,120

In 2009 big items were:

Rent: $6,803

Transportation: $1,462

Utilities: $1,235

Charitable donations: $744

And I still had plenty of money left over to travel and contribute fully to my IRA each year.

Mike — April 13, 2011

In my opinion, any national level data on this sort of thing is practically useless. Where I live, $690 a month on housing (which is what their bare minimum works out to) pays for the mortgage on a 3,000 square foot home within a ten minute drive of a major midwestern urban center. In New York City it wouldn't cover a studio apartment.

When the variance is this large, I'm not sure that talking about the median income needed for a family across the US is really that useful...

Marc — April 13, 2011

My underlying grump with this basically reflects what Malta said in the response to my first. Laying out a "security minimum" is step 1 toward demanding that the social safety net top everyone off to that point, because security sounds like something everyone ought to have.

Motivation matters, whether that is motivation to be thrifty, or motivation to work. Living in a too-generous social safety net is like living in space. Your muscles atrophy without something to push against.

AlgebraAB — April 13, 2011

I would echo what Marc said. I was raised by a family above the poverty threshold but not by very much, maybe 3 or 4 thousand dollars of income per year (I'm in my early 20s by the way, so this is relatively recently). This was in one of the most expensive housing markets in the nation (Los Angeles metro area). There were definitely bumps along the road but, for the most part, we've done fine. I know there are millions who do the same every day. I even managed to live in New York City for several years on an income that was below poverty-level. New York isn't as outrageously expensive as people claim if you widen your horizons and look beyond Manhattan. I was living alone at that time but I knew lots of families who were making less than what the Wider Opportunities for Women guidelines suggest and they had what I considered to be a fairly stable home life.

It all depends on expectations. I think that the guidelines above are not so much about economic security (very few individuals in the world have true economic security that would survive catastrophe - I know people today who once had a 7-figure net worth that has been wiped out) as much as they are about "keepin' up with the Joneses." In my current occupation I often end up reviewing financial information for families and I'm shocked at how many people who make $40K, $50K, $60K a year are still in ridiculous amounts of debt. Sometimes it is due to catastrophic situations (medical bills usually) but the majority of the time it just has to do with the fact that they "can't" tolerate a lifestyle below a certain threshold. So many people find it unthinkable that one would give up an auto and use public transportation instead, or that one would rent a modest apartment instead of buying a $300,000 home. The reason is usually cultural. People either don't want to be seen with "them" (i.e. the blue collar, majority-ethnic people who ride the bus or live in "the ghetto") or they grew up so coddled and spoiled that the idea of financial discipline is basically alien to them.

I should mention that I'm also the child of immigrants. I've often payed visits to my parent's birth country, which is in the Third World. That has certainly been an eye-opening experience for me. I basically realized that the majority of the globe lives in the Third World (I think currently 50% of humans alive on Earth subsist on less than ~$3 a day). The majority of hard physical toiling labor (i.e. agriculture, heavy industry and domestic work) is performed by people in the Third World or Third World immigrants in the West, while most jobs in the West are more akin to leisure-related activities. And, those at, or in some cases even below, the poverty line in the West are wealthy (yes, wealthy) compared to the rest of the globe (I believe that every American above the poverty line is in the Top 15% in the world in terms of standard of living). So ... really my perspective is that groups like Wider Opportunities for Women are just really myopic.

That sentiment is only strengthened when I see that there is no plan on how to actualize these new standards in reality. Where is the money going to come from to assure that a family of four makes close to $70,000? Would we just float more debt - sell more Treasury notes to Chinese banks? And is that really fair? To say "Americans can't tolerate anything less than First World middle-class standards, so we're going to have Chinese industrial laborers (via their savings in Chinese banks) pay for our lifestyles. Oh, and we're never paying back them back." I add that last part because, if teachers in Wisconsin who make $60,000 a year can't tolerate a 3% pay cut, then there is no way that American society as a whole can tolerate the kind of austerity that would be needed to pay back our debts in full over the next 30 years. I also see nothing here related to gains in physical productivity - if this were part of a export-focused re-industrialization plan that promised new jobs manufacturing high-profit margin commodities then I could get behind it but, as of now, I imagine people expect to earn $70,000 just for being a paper-pusher or working in retail or something. Again, people are myopic. People compare themselves to "Real Housewives" or Donald Trump and feel poor. If they were to compare themselves to, well, the vast majority of human beings alive on the planet right now ... they would realize how enormously privileged they are and maybe take things in with some context.

Che — April 13, 2011

Wow. The post made me feel better about my inability to make ends meet on $23K a year - and the comments made me feel like crap about it again. Maybe it's the result of some luxuries in the past, like optional (but needed) surgery and graduate school, but I'm lucky to break even - and if you don't have astronomical medical bills (even with fairly good employer health care I have close to $10K from a surgery and a non-optional hospitalization), you're lucky these days. My rent is reasonable ($475/mo), but the trade-off is awful gas expenses. And even with income-based loan repayment, I can't always afford my student loan payments. Having just borrowed $6K from my family (which increases my income this year by a third), I'll BARELY get by.

Fuzzy — April 13, 2011

My health insurance is nine dollars, biweekly. If I had kids and a spouse, it would be about forty dollars, again biweekly. What you pay in health insurance is not a constant.

Fuzzy — April 14, 2011

Fortnightly. Per payday, specifically.

Fuzzy — April 14, 2011

I think that one of the things implied by this whole idea of security is the notion that one starts out that way, and I'm not at all sure that we as a nation should support either that level of consumption or that level of arrogance. An awful lot of the people one sees as "stable" now lived on beans and rice in order to get a college education--even with the GI bill or other assistance. My first baby slept in a dresser drawer when she wasn't in my bed because we had no heat. Several of my kids wouldve gone naked if my parents hadn't provided winter clothes.

I'm concerned because we see a base requirement for survival that presupposes an arrogNt and unsustainable amount of resource consumption for no reason. Not only the spiffiest baby stuff, but gods help us if it isn't new--never mind that a newborn doesn't wear ANYTHING out except the parents.

ADub — April 14, 2011

I don't see this study as prescriptive as much as I see it as a way to explore and discuss an idea. I'm not sure the point being illustrated is that no one's making it on less than 30k. I think part of the idea -is- how to make departure from poverty a reality. What savings, health insurance, home ownership, higher education can do, even though they are not necessary to survive, is bridge someone out of paycheck-to-paycheck living towards the next class bracket.

And by the next class bracket I don't mean the ability to buy spiffy baby stuff, or to keep up with the Jonses. I feel like it's the difference of being able to have a bank account or having to cash your paychecks at someone else's profit, being able to access credit in times of need or spending a lifetime paying back even small amounts of debt, spending tens of thousands of dollars on rent or someday having a space ostensibly your own.

Can some people do this with less? Obviously, yes, we have great anecdotal evidence in this post alone. But as usual it's going to work particularly well if you're white, male, able-bodied/healthy, single, childless, and/or have the luck to know exactly what you need to do, and do it. Hopefully, nothing unexpected will happen to you before you make it out. Hopefully, you'll have a network of people who can help you out when you need to make ends meet.

I don't think we immediately need to start legislating that no one will ever make below 30k - I think this study is a tool to evolve the conversation about what the "poverty line" really means. Why has that made so many people so defensive? I think it should be okay to at least talk about how tough it is to be poor, even if we might have different ideas about how to respond from a policy perspective.

Economic survival or economic security — what’s acceptable? « MaggieCakes — April 17, 2011

[...] Apr Recently, Sociological Images has had some coverage on what it takes to make ends meet in a household budget. (Here’s an [...]