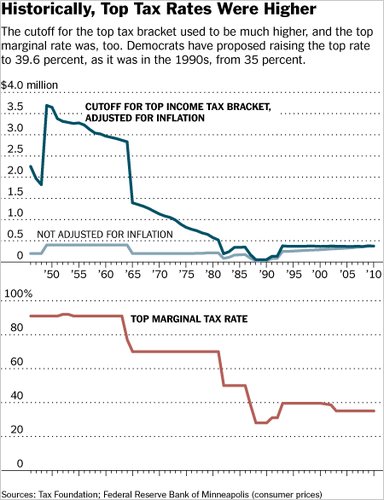

To provide a little context to the current discussion about extending the Bush-era tax cuts, the New York Times has an interesting graph up that shows changes in the level at which the top tax bracket kicked in, as well as the % tax rate in the top bracket:

So on the one hand, in constant dollars, you used to have to be quite a bit richer before you hit the top marginal tax bracket, because we had a wider range of brackets and differentiated incomes more than we do now (taxing an income of $500,000 differently than one of $5 million, whereas now we’ve basically collapsed all those brackets). But now, the highest income tax rate is well under half of what it was in the ’50s.

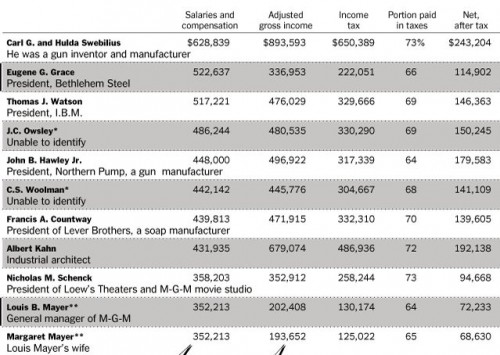

This chart shows the incomes and tax levels of the 10 Americans with the highest salaries (as opposed to wealth from investments, capital gains, etc.) in 1941, data we have because in 1943 President Roosevelt asked for a report on top earners:

I keep hearing news organizations discuss the existing tax cuts, and their possible extension, in a way that seems a bit confusing, by saying it’s a tax cut for people making “up to” $250,000, or $500,000, or however much the cap is for the different plans being thrown around. That seems to imply that, say, everyone making $250,000 or less gets a tax cut, and anyone making $250,001 gets nothing at all. Just to clarify, under all these plans, everyone would receive (or, more accurately, keep the existing) cut on their first $250,000 (or whatever the chosen cutoff would be).

At issue is whether that same tax rate should apply to all income, or whether beyond a chosen cutoff, the Bush tax cuts would expire. In that case, if you made $300,000, say, you would keep the tax cuts on your first $250,000 in income (and thus pay roughly 35% in taxes), but pay a higher rate on that last $50,000 (about 39%). You wouldn’t pay the higher tax rate on your entire income. And I think that’s getting lost a bit in the use of phrases like “middle class tax cuts” or “tax cuts up to X dollars.” That’s separate from whether or not you think extending the tax cuts are a good idea, but I just wanted to take a second to clarify what I think is an easily misunderstood point, made worse by the way it’s being reported on.

Comments 9

psimon299 — December 5, 2010

Of course they've brought down the cutoff for the top bracket. The thinking is, the more people you put in that bracket, the better the chances that the rate for the top bracket will affect a lot of people - all screaming for the rate to go down - instead of for the cutoff and rate to go up.

notlaika — December 5, 2010

Not totally on-topic, but that table -

Why isn't Margaret Mayer's job listed? All it says is that she's Louis Mayer's wife - surely the actual job that she's getting such a huge salary for would be more important information to include?

That being said, it's kind of cool that she made it on to the list in that era, and was listed separately instead of being lumped in with her husband like the Swebilius.

Scapino — December 6, 2010

"I keep hearing news organizations discuss the existing tax cuts, and their possible extension, in a way that seems a bit confusing, by saying it’s a tax cut for people making “up to” $250,000, or $500,000, or however much the cap is for the different plans being thrown around. That seems to imply that, say, everyone making $250,000 or less gets a tax cut, and anyone making $250,001 gets nothing at all. Just to clarify, under all these plans, everyone would receive (or, more accurately, keep the existing) cut on their first $250,000 (or whatever the chosen cutoff would be).

At issue is whether that same tax rate should apply to all income, or whether beyond a chosen cutoff, the Bush tax cuts would expire. In that case, if you made $300,000, say, you would keep the tax cuts on your first $250,000 in income (and thus pay roughly 35% in taxes), but pay a higher rate on that last $50,000 (about 39%). You wouldn’t pay the higher tax rate on your entire income. And I think that’s getting lost a bit in the use of phrases like “middle class tax cuts” or “tax cuts up to X dollars.” That’s separate from whether or not you think extending the tax cuts are a good idea, but I just wanted to take a second to clarify what I think is an easily misunderstood point, made worse by the way it’s being reported on."

What? Who cares? That's just a tricky way to present tax rates. Ignore the marginal tax rates, focus on the effective ones. If I make $300,000, my taxes are going to go up.

Let's be horribly general, and divide the US into two tax brackets ($250,000) with respective marginal rates of 35% for both if everyone's Bush cuts are extended, and 39% for the >$250,000 bracket if that rate goes up. Take two individuals, making $100,000 and $500,000.

With the cuts:

$75,000 income- $26,250 in taxes, effective rate of 35%.

$500,000 income - $175,000 in taxes, effective rate of 35%.

Without the upper income cut:

$75,000 income - still $26,250 in taxes, effective rate of 35%

$500,000 income - $87,500 + $97,500 = $185,000 in taxes, effective rate of 37%

Hey, it went up! Note that I could have achieved this same result by not presenting it as "35% on income under $250,000, 39% on over" and just said "35% for people making less than $250,000, 37% for people making over that."

If your effective rate increases, it doesn't matter what part of your income is being taxed at what rate. Unless you're sitting in a room trying to decide whether it is worth your time to go work for one more hour that day, the marginal tax rate isn't terribly important.

This reminds me of those credit card programs where you can pick which purchases your payments go to. Who cares if you're paying off the couch or the groceries? It's financially identical, and just a way to trick financially illiterate people into being happier.

james morisseau — December 7, 2010

who pays $26,000 on taxable income of $75000? Or even $100,000?

a single person pays $21,713, a Couple pays $17369, and that's without itemizing or taking any other credits. Then figure in the difference in the FICA Tax and the higher income person pays a lower rate overall.

Instead of being "horribly general", why not just say "horribly inaccurate"?