Third Way, which describes itself as “the leading moderate think-tank of the progressive movement,” proposes that taxpayers should get a receipt showing where their taxes go. They point out,

For many Americans, the amount they pay in taxes is larger than any purchase they make during the year, but studies show they know almost nothing about where that money goes to. This contributes to ridiculous beliefs, like the view that 20% of government spending goes to foreign aid, for example.

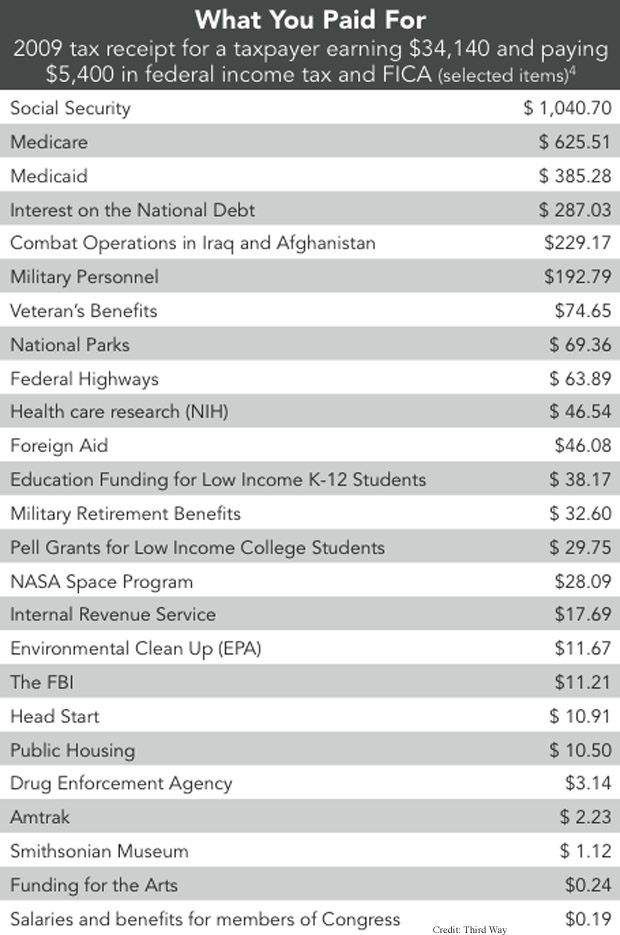

They provide a sample receipt for a taxpayer making $34,140, the median income in 2008; the receipt doesn’t include everything, but major categories of interest or that taxpayers tend to be very unclear how much money is spent on:

Via Talking Points Memo.

It’s not a receipt, but you can calculate how much you pay in taxes to various programs based on your income here.

Comments 16

mordicai — October 2, 2010

I find it interesting how broken down defense spending is-- if it was all lumped together like many of the other categories, it would be quite a bit more of a shocker, neh?

Mucus — October 2, 2010

This is pretty cool, I wonder if there is one for Canada

asada — October 2, 2010

Interesting that congress gets soo little......

Fernando — October 2, 2010

$10.00 emitting tax receipt

Carolyn Dougherty — October 2, 2010

This is a great idea--but like mordicai I wonder about the categories of military expenditure. I see one for 'military personnel', but don't know how that breaks down into, or even if it includes, military contractors and payments to defence contractors for weapons and military hardware/supplies (I kind of think it might not; I thought the number for the latter was a lot higher).

T — October 2, 2010

I think seeing something like this as an official summary published by the GAO would be a great thing. It really help makes clear how money is spent...

AND it could help make REAL how X, Y and Z services are funded by the government and how it relates to the individual. It could really help the conversations when you start with this perspective.

For example, "Is $5.81 per year too much for me to pay in order to help ensure my children's toys and my workplace are safe?" (Consumer and occupational health and safety -- annual budget of $4.4 billion.)

Or... "Is $28.35 per year too much for me to pay for the entirety of Air Transportation expenses including aviation security, air traffic control, aviation and air transportation research and development?"

Sort of simple questions to ask when someone says, "The government is too big and is taking over!" Is the government bloated? Yes. I don't think there's any controversy there. The question is, In what way? Which parts are you willing to cut or reduced? Would private enterprise do X Y or Z better (for less)? Is it inappropriate that this is a socialized expense? Or should it be targeted to specific users? And so on. I have my own answers to all of these questions... but that's not my point.

ALSO -- A key point would be not just be what is *Your Share* of the government's expenses. You have to make sure it's clear how much you actually PAY in taxes. (i.e., Is your share larger or smaller than what you actually pay for? -- in other words, Are you contributing to or reducing the deficit?)

Basiorana — October 2, 2010

That tax calculator was depressing. I make so little money that there were negative numbers on there.

j-p — October 3, 2010

Even put together, I thought the military expenses would be a lot more.

Adam — October 3, 2010

Honest accounts of military spending as portion of tax money are a lot higher. This one is suspiciously and conspicuously excluding most of the DoD budget. The link at the bottom does a better job, but some other sites rate defense spending as much as 27% of income taxes. http://www.globalresearch.ca/index.php?context=va&aid=5307

http://www.warresisters.org/pages/piechart.htm

Sadie — October 3, 2010

.24 cents for the Arts. That's pretty damn affordable. Can people stop bitching about how much it costs to support the arts now, PLEASE?

Jeremy — October 3, 2010

You might also check out this site: http://www.whatwepayfor.com/

Its a little rough and still in the every present beta, but it might have good information.

AR — October 4, 2010

This falls short in that it doesn't seem to include inflationary deficit spending, which also takes money out of people's pockets but in a much more subtle way, and in a way which cannot be pinned down to the income and wealth of specific people.

This tax receipt concept continues to ignore the large fraction of government consumption that is invisible by design.