Keeping a trend in perspective.

The sociologist down the hall pointed out that yesterday’s chart gave the impression of a whopping increase in TANF (Temporary Assistance to Needy Families) support for poor families. But I have been complaining since December 2008 that the welfare system is not responding adequately to the recession’s effects on poor single mothers and their children. I wrote then:

We now appear headed back toward a national increase in TANF cases. But the restrictive rules on work requirements and time limits are keeping many families that need assistance out of the program…. If the government can extend unemployment benefits during the crisis, why not impose a moratorium on booting people from TANF?

So it does seem contradictory that I would post a chart yesterday showing a huge increase in TANF family recipients, and continue the same complaint. So let me put it in better perspective. It’s a good lesson for me on the principles of graphing data, which I have made a point of picking on others for.

Height and width

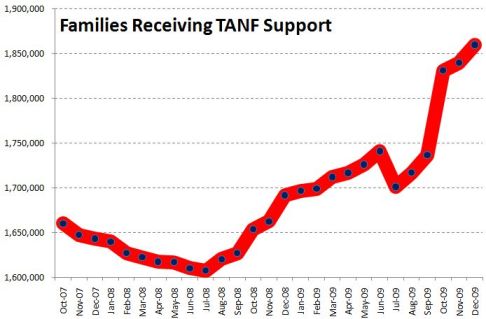

There were two problems with yesterday’s chart. First, the vertical scale only ran from 1.6 million to 1.9 million families. Second, the horizontal scale only ran for 26 months. I’ll correct each aspect in turn to show their effects. Here’s yesterday’s chart:

It sure looks like a dramatic turnaround. And any turnaround is a big deal. I wrote last year:

What should be striking in this is that the rolls are increasing even as the punitive program rules continue to pull aid from families according to the draconian term limits dreamed up by Gingrich, ratified by Clinton and endorsed by Obama — 2 years continuous, 5 years lifetime in the program. The current stimulus package includes more money for TANF, to help cover an expected growth in families applying — but no rule change to permit families to keep their support in the absence of available jobs.

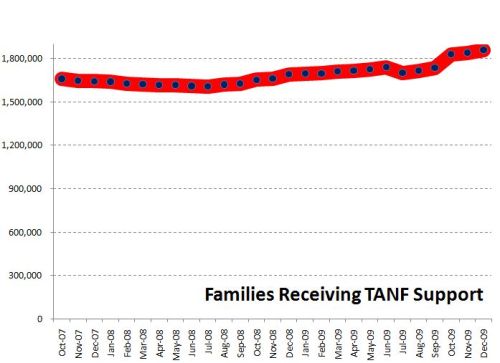

But, run the vertical axis down to zero, and the same trend is not so dramatic:

Now the big bounce since July 2008 is put in perspective. We’ve seen a 16% increase since that bottom point, but the response seems much more modest in light of the size and impact of the Great Recession we’ve come to know.

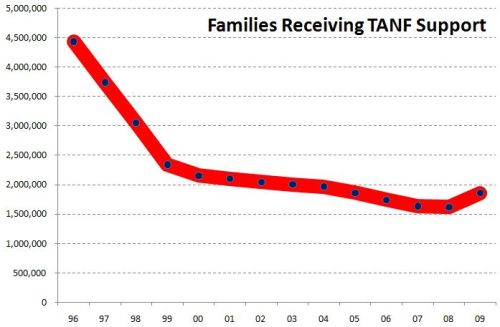

In fact, though, the longer-term view underscores how paltry that response has really been. Back the chart up to 1996, and you can see how small the increase has been compared with the pre-draconian reform period:

All three images are correct, but their emphasis is different. To me, the important take-home message from this trend is, “That’s it? The greatest economic recession since the Great Depression, and our welfare response was that measly uptick? Our system really is a shambles.”

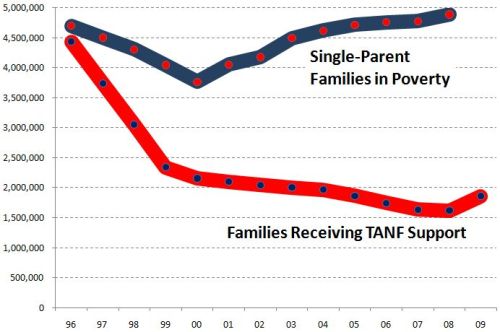

One important issue remains, however, and that is some measure of the need for welfare. So consider the number of single-parent families below the poverty line, compared with the number of families receiving TANF (formerly AFDC):

Now the story is much more clear.

After welfare reform in 1996, the number of families receiving welfare was cut by half in just a few years. At the same time, however, the number in poverty dropped. Since then, as the number in poverty has increased, the number on welfare has not. The two trends appeared to be uncoupled through most of the 2000s. In the last year we’ve seen the first increase in TANF numbers since 1996, but nowhere near enough to meet the increase in poor single-parent families.*

It is still the case that, although the stimulus bill allocated more money to TANF, the punitive rules and term limits have not been changed. So the system does not address longer-term poverty — something we should expect to see much more of in the next few years.

*We don’t have the official 2009 poverty rates yet, since they are compiled from a survey done in March 2010, to be released this fall.

Philip Cohen, PhD, is a professor of sociology at the University of North Carolina at Chapel Hill, where he teaches classes in demography, social stratification, and the family. You can visit him at his blog, Family Inequality, and see his previous posts on SocImages here, here, and here.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 7

Anonymous — June 3, 2010

Thank you. Of course, I know this well, as the mom of a TANF-eligible family of six who doesn't apply because of those very rules.

Why am I on the internet? Well, actually, I'm damn lucky to have been able to use August's rent to cover the phone bill, with a shut off notice for tomorrow, especially since we rely on the internet for work and school. I hope I'm as lucky in August and don't end up evicted, but so far, so good.

Incidentally, I'm married, my husband has a master's degree & I'll have mine in half a year, and we've both been looking for work for almost a year (though he already has two part-time jobs).

I also have $40K in student loan debt because I was silly enough to believe the lie that a good student from a poor family could succeed by getting an eduction. Sallie Mae, 40,000, me, 0.

Sorry for the ramble.

Ben Zvan — June 3, 2010

An interesting thing to note is that, under President Clinton, both the poverty rate and the number of people on TANF went down. I'd call that a 'good thing.' Then, under President Bush, the poverty rate took a rapid upturn with no change in the roughly horizontal trend (that started before his election) in the number of people on TANF.

Ed — June 3, 2010

To make a parallel observation, about six years ago I was fired and thus made unemployed about six years ago (when the economy was "OK", but hardly great). I was number six of eight managers in my department who was fired in a six month period (followed by at least one more), but I am sure it was my fault.

Anyway, anyone who says that unemployment compensation is a disincentive to look for work has never been unemployed and/or is a damn liar. I was on the computer for about six hours a day, looking on the online job sites. I applied for every corporate job in my field (accounts payable/clerical, a nice generic field) that I could, and also started applying for temp jobs.

only received a few UC checks before I got a temp job that paid about the same as my UC checks. I lost that after a few weeks, and had to go back on the UC checks. I picked up another temp job a few weeks later, and as it was ending I picked up a third temp job (ironically not one I had applied for, I was recruited to be a temp ... at a temp firm) and even though at this job they liked me, gave me a decent raise to keep me after three months and also extended my contract, I still applied for and eventually got my current permanent job.

I never got too close to depleting my UC benefits, but that was because I worked hard and continually looking for and applying for jobs. Even when I was working I would spend lunches and two to three hours a night looking on the web.

I would have to say I was lucky, not merely because I am a college educated, relatively experienced white guy willing to take entry level jobs just to get a check, but because I could go on my wife's health insurance plan, and my (now ex-) wife was willing to take a second job to help make ends meet.

When I was unemployed or underemployed, I was scared. Scared that I would never get a decent job ever again. I still have some of that fear. That was a pretty powerful motivator. I suspect that many others share that fear. That's why when modern economists annoy me so much. They suggest that the unemployment rate is so high because UC is a disincentive to look for work until just before it runs out, instead of the behavior of financial corporations.

Timm! — June 4, 2010

Edward Tufte would be pleased :-)

Tomato Sauce — June 12, 2010

http://www.atimes.com/atimes/Global_Economy/LF10Dj02.html

"While the culprits of the global credit meltdown of 2008 have been bailed out with the public's future tax money, the sovereign debt crisis across the globe is blamed on innocent wage earners for receiving supposedly unsustainably high wages and excessive social benefits that allegedly threaten the competitiveness of economies in a globalized trade regime designed to push wages down everywhere."

"Recent figures from the German Bundesbank showed that in 2008 and 2009, some 53% of Germany's new public debt was used to rescue distressed financial institutions. The total new public debt rose by 183 billion euros in those two years; the costs involved in supporting distressed financial institutions amounted to 98 billion euros."

anne — October 17, 2010

I am severely disabled. I had to wait 8 years for social security, during which time, my 3 children & I lived on $600. a month child support. Had I accepted TANIF (welfare) my child support would go directly to TANIF. Tanif was going to give me LESS than I got in child support.

Assistance MY ASS.