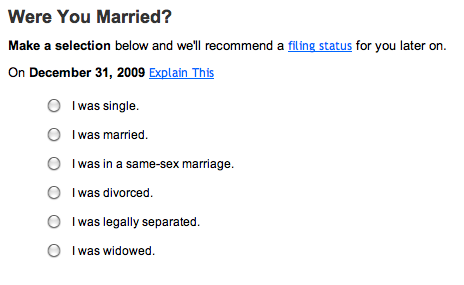

Amanda S. took a screen shot while doing her taxes online at Turbo Tax. The program asks if the filer is married or gay married:

What a fascinating moment in U.S. history. In some states a person can marry someone of the same sex, in others they cannot. Tax programs trying to help people file their federal and state taxes need to record both kinds of marriages because they collect information for both tax returns simultaneously in order to reduce the time burden on the client.

But why not just ask people if they were married? Perhaps the people who designed these questions thought that the term “marriage” is so deeply associated with heterosexuality that it wouldn’t occur to people who were married to someone of the same sex to check it. Then again, I would think that those gay couples who are legally married would be especially cognizant of their right to check the “marriage” box whether same-sex marriage was specified or not.

Or are there different tax rules applied to gay and straight marriage?

In any case, if we’re going to separate homo- and hetero-marriage, why not label “marriage” as “opposite-sex marriage” or “other-sex marriage”? Why normalize heterosexual marriage (real marriage, you know, the original marriage, marriage marriage!) and mark homosexual marriage (the gay kind, duh, so gay)?

I don’t know what they were thinking… but it’s fascinating.

Happy tax day U.S. Americans!

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 36

HD — April 15, 2010

I would imagine, and this might be wrong, that those who were same-sex married in a state that allows it (e.g., Massachusetts), but currently live in a state where it is not legal (e.g., Georgia), would not be entitled to at least state tax benefits regarding marriage. While a couple who are married in a state recognizing same-sex marriage and living in a state that recognizes same-sex marriage would receive benefits.

I'm not sure if this is the case at all, but just considering possibilities.

MPS — April 15, 2010

You seem to answer your own question: presumably there are different tax rules depending on whether you are gay or straight married. These could be federal, but they could also be state (in fact we know there are such different rules for states, right?), since TurboTax evaluates both.

So the only sociological question -- which I agree is very interesting -- is why ask "marriage" vs "same-sex marriage" as opposed to "heterosexual marriage" vs "homosexual marriage" or whatever.

Ollie — April 15, 2010

The last point you make is a good one. They consider normal marriage to be heterosexual. Maybe in a decade or so that won't be the case. Frankly, I'm surprised it doesn't take generations.

Philip Cohen — April 15, 2010

I completely agree -- well said.

We have the same thing in academic studies of marriage. Some are about "marriage" and some are about "same-sex marriage." I have just written an article proposing that we call them all "marriage" and then differentiate between "homogamy" and "heterogamy" if needed (coming out next year -- let me know if you'd like a copy, contact info @ the link). "Same" and "opposite" are not good terms anyway -- just exaggerates gender differentiation.

(FYI: The IRS doesn't recognize same-sex marriage even if you live in a state that does.)

Meg — April 15, 2010

Thanks to DOMA, there are different tax laws. Only heterosexual marriages can "count" on federal taxes, while same-sex marriages may or may not allow people to file their state taxes as "married", depending on the state. So there is a systematic reason to ask this question this way, a product of government homophobia.

REAvery — April 15, 2010

Well, I was hoping we (as a society) would call things that are legally marriage "marriage" and not make an arbitrary category for same-sex marriage, buuuuttt...I guess that is too much to hope for, really.

You brought up a good point though, that "gay marriage" is marked and "straight marriage" is unmarked. As long as people insist on using a qualifier for a marriage between homosexuals, we need to start using a qualifier for a marriage between heterosexuals. I.E. We really do need to start saying "other-sex marriage" or "straight marriage" or whatever else. The terms don't really matter as much as not allowing "marriage" to default to "straight marriage" and then having these weird "gay marriages" on the side.

This is for much the same reason as we have a qualifier for whites, straight people, cis people, etc. It doesn't stop POC, gays, trans people etc. from being a socially marked class, but it can't hurt to stop marking people linguistically as well.

Ryan — April 15, 2010

It is because of tax laws. Same sex couples who are legally married in their state of residence are not permitted to file jointly with the federal government and can and are accused of tax fraud.

jfruh — April 15, 2010

Do people honestly not know the practical reasons for this question? First of all, the question is being asked by TurboTax, not "The U.S. government." TurboTax is put out by Intuit, a private corporation.

The U.S. government (or at least the tax authorities) doesn't want to know if you're gay married; the Defense of Marriage Act forbids the federal government from recognizing those. If you are married to someone of the same sex, you are still considered single for federal tax purposes. Some states *do* recognize same-sex marriage, though, and treat same-sex married couples as married for tax purposes. TurboTax needs to know this so that it can do your taxes accuratedly -- in other words, if you are in a same-sex marriage in Iowa or Massachusetts, TurboTax will treat you as single for your federal return but married for your state return.

As a side note, I believe that states that have civil unions or domestic partnerships that offer all the rights of marriage without the name also treat people in those partnerships as married for tax purposes, which means that TurboTax's Q&A really ought to cover that possibility as well.

Amanda S. — April 15, 2010

I understood the reason for this question when I encountered it--if I were in a same-sex marriage, the federal government would treat me as single and Massachusetts would treat me as married, for tax purposes. It's a necessary question for tax software to ask.

What I found funny/sad was the *way* they asked it--how "married" and "in a same-sex marriage" were mutually exclusive categories. To me, this is like if the census asked you if you were a "person" or a "black person"...

KarenS — April 15, 2010

I think some people would be confused if they labeled it "opposite-sex marriage" instead of just marriage. Most people here are aware of such things, but I'll bet there are a number of people who aren't very sophisticated, who think they are simply "married" and would wonder about the opposite-sex wording.

I know it's petty, but I'm usually a bit annoyed when I must choose "divorced" instead of single. I had a very brief marriage over a decade ago, so I'm stuck with a label I can never get away from. When turbotax does it, though, I understand, because they care about things like whether money is being exchanged between my ex and me.

tl — April 15, 2010

This is TurboTax's language, not the US government's.

Alan — April 15, 2010

First, I understand the complaint, and agree that there are underlying sociological issues that are problematic in our country. I understand that seeing "marriage" vs "homosexual marriage" can have a negative subconscious effect emphasizing that "homosexual marriage" is generally considered "not normal" - and so, labeling the choices like this is worth questioning. However...

Isn't there something to be said for "normalizing" the case that is more common? There is a necessity to differentiate between the two cases here, so just unqualified "marriage" doesn't work. There are a lot more opposite-sex marriages, so in a simply numerical sense, that is "normal" while the other case is "abnormal". Yes, the discrepancy is probably largely due to the society we live in, but why is that relevant here? One is more common than the other, and the labels they chose are the simplest ones that make sense.

If you're buying a truck, you probably choose between a "truck" and "diesel truck", not "gasoline truck" and "diesel truck". This analogy is not valid sociologically - we don't have to worry about alienating the diesel trucks and making them feel bad - but it is valid semantically.

My point is, if you are either A. striving for simple text or B. ignorant of the sociological issues, then the labels they chose make perfect sense.

Penny — April 15, 2010

Lisa, you're in California--did you notice that on the federal forms the second signature space is labeled "spouse," but on the state forms it asks for "spouse's/rdp's signature" (RDP=registered domestic partner)?

Agreed with all the above--it's not the US government that wants to know; it's Turbotax, so they can help you do your taxes correctly for the state you're in.

Bailey — April 15, 2010

Huh. My tax forms only asked if I was married, no hetero- or gay- prefixes. But I filed in MI and NC, neither of which have legalized same-sex marriage. Which might have something to do with it?

Lisa Wade, PhD — April 15, 2010

Hello all,

Thanks for the correction on who was inquiring. I changed the title of the post.

- Lisa, SocImages

Bailey — April 15, 2010

Wait, I did mine on Turbo tax, AND I did them after I saw this post, so I was looking out for it! I never got asked this question. *ponders*

I was doing the tax freedom version, for people who make less than $31k or are members of the armed forces. I don't know if that makes a difference.

Lisa Wade, PhD — April 15, 2010

Oh and, just FYI, I am in California and I did get this question.

Anonnymouse — April 15, 2010

It would be simple to fix this.

On December 31, 2009,

- I was married according to state but not federal law.

- I was married according to [state and] federal law.

- [all the other choices]

Oregon's state tax forms also have RDP and instruct you on how to deal with the discrepancy between the state form and the federal 1040, since you have to give the state a copy.

JT — April 15, 2010

It's too bad a distinction has to be made at all, but it would have been thoughtful of Turbo Tax to change the "married" option to "opposite-sex marriage" or something similar.

I live in Canada, and I used the Canadian version of the site to estimate my refund. Here there is no same-sex marriage option, just married. Nice, huh?

Basiorana — April 15, 2010

"Or are there different tax rules applied to gay and straight marriage?"

Yes. Same-sex marriages do NOT apply to federal taxes, since the federal government does not recognize them. They DO apply to state taxes in states where same-sex marriages are legal, and they do to a lesser extent in states with civil union laws.

Thus they do need to make a distinction and it's not about an arbitrary second category for marriages between people of the same sex.

I think writing "opposite-sex marriage" would just confuse a lot of people. We're used to thinking of "same-sex marriage" as a term and an idea, but no one uses "heterosexual marriage" or "opposite-sex marriage" so people would get confused. And ultimately, we don't want TurboTax to identify "opposite sex marriage," we want both kinds of marriage to be under "married."

Natalia Soul. — April 16, 2010

This is just wrong. This is plain wrong.

I will go further, though. They shouldn't ask this at all. Not my sex and not my status. When you file taxes it should not matter. No advantages to marry or be single. No advantages to be hetero or gay.

This subliminal screening should not go unpunished.