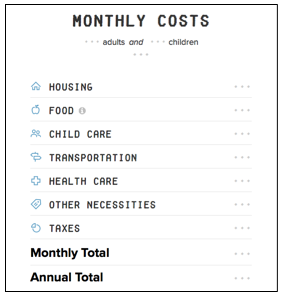

Have you ever wondered how your living conditions might change if you moved? Maybe you have asked yourself what your living conditions are like compared to a relative or friend. The Economic Policy Institute developed a family budget calculator with answers (currently using data from 2014). The family budget calculator measures what one’s household income would need to be to achieve an adequate standard of living for 10 different family types in 618 locations across America. Essentially, this budget tool paints a picture of where families stand economically in America today.

Have you ever wondered how your living conditions might change if you moved? Maybe you have asked yourself what your living conditions are like compared to a relative or friend. The Economic Policy Institute developed a family budget calculator with answers (currently using data from 2014). The family budget calculator measures what one’s household income would need to be to achieve an adequate standard of living for 10 different family types in 618 locations across America. Essentially, this budget tool paints a picture of where families stand economically in America today.

This goes beyond personal reflection: As economist Elise Gould and colleagues explain in their accompanying report, What Families Need to Get By, “[their report] and the Family Budget Calculator itself measure(s) the income families need in order to attain a secure yet modest living standard where they live by estimating community-specific costs of housing, food, child care, transportation, health care, other necessities, and taxes.”

What I can see right now. As I explored EPI’s family budget calculator I thought of some of the ways I could use it pulling on two parts of my identity, recent college graduate on the job hunt and a sociologist. As a recent graduate, I have been applying to jobs in various states and cities. EPI’s family budget calculator is a good resource for mapping out what my salary would need to be and if I would need a roommate, or two. For instance, using EPI’s calculator I found out in Washington, DC, my housing cost would be about $1,176. If I stayed in the Boston, MA, area my housing cost would be about $1,042. Looks like I’ll need a roommate either way.

How students can use this tool. It is also easy to see how this tool can be used for students in various classes. For example, it can be used to discuss public policy. One of the costs measured with the EPI family budget calculator is childcare. A policy class could compare how different state childcare policies affect a family’s budget using the EPI calculator. EPI is due to update their family budget calculator this fall, and I am looking forward to seeing what new costs they will consider. With Devos rewriting student loan forgiveness rules how might EPI measure education costs? Students especially may be interested in looking into variances in the cost of education. I start paying student loan in about a month so I know I’m curious.

EPI has even more to consider approaching the update of their family budget calculator given the current state of health care. In the 2015 update, EPI made adjustments to account for the premiums available under the Affordable Care Act. With health care up in the air as I write this, how will EPI measure this? It is a task, we all have come to understand, that is rather complicated when there is no saying what will or will not happen to health care in America. Students can take this puzzle and run with it, investigating additional concerns that will likely be on their minds—and that are relevant for understanding the social world.

But about the bigger picture. Of course, EPI made this calculator to link specific, personal cases to larger policy concerns. That’s a core activity for the “sociological imagination.” The family budget calculator points to policy questions such as what an adequate minimum wage would be, what are appropriate levels of social insurance like unemployment insurance or TANF? It offers ideas about the kinds of wages and benefits that would make private sector jobs livable for all families, too. EPI’s calculator gives students, researchers, and all with a curious mind and a family budget a good tool: Examining the impact of context reminds me of how much policy isn’t about me, but it affects me, and all of us, personally.

Megan Peterson is a 2017 graduate in sociology from Framingham State University and a Council on Contemporary Families Public Affairs and Social Media Intern.

Comments