In the lasts 15 years, student debt has grown by over 1,000% and the debt held by public colleges and universities has tripled. Where is the money going?

The scholars behind a new report, Borrowing Against the Future: The Hidden Costs of Financing U.S. Higher Education, argue that profit is the culprit. They write:

Scholars have offered several explanations for these high costs including faculty salaries, administrative bloat, and the amenities arms race. These explanations, however, all miss a crucial piece of the puzzle.

Sociologist Charlie Eaton and his colleagues crunched the numbers and found that spending on actual education has stagnated, while financial speculators have been taking an increasing amount of money off of the top.

Higher education fills the pockets of investors in three ways:

- Interest on student loans, paid by students and parents.

- Interest paid by colleges who take out loans to fund projects — everything from new academic buildings to luxury dorms and stadiums — ultimately repaid with tuition hikes and higher taxes.

- And profit from for-profit colleges (with “dismal graduation rates, by the way).

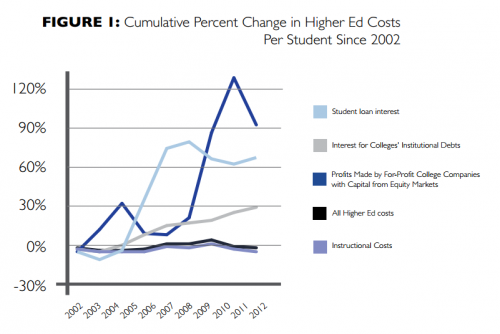

Take a look at this figure breaking down the sources of the rise in the cost of higher education. Interest on debt — taken on by both students and the colleges they attend — has risen. Meanwhile, direct profits from for-profit colleges have skyrocketed.

Overall, Eaton and his colleagues found that Americans are spending $440 billion dollars a year on higher education and that 10% of that goes into the pockets of investors who are skimming profit off of all forms of higher education.

Want more? Read their report or watch their summary:

Cross-posted at Pacific Standard.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 12

Mr. S — July 8, 2014

This smells like an awful lot of blame shifting. Average college tuition has gone up something like 1200% over the past 30 years. How is Wall Street responsible for that? Enormous principal begets enormous accumulated interest payments, even as the Fed has exerted its influence to actually push interest RATES down.

And it's Wall Street's fault that in ADDITION to tuition hikes, colleges are taking out loans to fund capital projects they couldn't otherwise afford? In essence, tuition costs would need to be even higher for these colleges to not accumulate debt (paid off by higher tuition later anyway)?

The for-profit school argument is a red herring. If such schools are both worse and more expensive, college-bound consumers should be wise enough to not purchase their product.

It's absolutely administrative bloat and expensive amenities driving the costs. Here is a particularly egregious example: http://www.aei-ideas.org/2012/10/administrative-bloat-at-ohio-state-where-the-ratio-of-full-time-non-instructional-staff-to-full-time-faculty-is-more-than-6-to-1/

As an aside, accumulated debt has exploded because graduates don't earn enough to justify the high tuition they paid. Students are constantly reminded what a great investment education is, yet for many, it fails to pay back in a reasonable timeframe. Blaming Wall Street is a diversionary tactic to shift attention away from the true fault.

Bentley D. Wilson — July 9, 2014

The responsibility lies square in the lap of traditional higher education. The financing costs have not increased. They are the same percentage they always have been. Its just the amount of borrowing has increased so much that it is now a bigger number because the borrowing pie has increased so much. The problem is our whole higher education system is completely out of sync with what it is supposed to be doing, educating our young people and preparing them for productive careers, not what they do today.

Graham — July 9, 2014

How does Wall St. benefit from interest on student loans? According to US Treasury Dept. reports, In Jan 2001 there was $67B of student debt owed directly to the federal government. In Jan 2009 that had grown to $120B. In May 2014 that is now $740B, that equals an increase of $620B owed directly to the federal government in the last 5 years and 4 months.

In Jan 2009 there was a $20B a year private student loan business in the US and about $500B of outstanding student debt. The largest lender, by multiples, was Sallie Mae, a government agency. Financial institutions earned a small share of that interest. After the Obama Administration nationalized all student loans the private lending business all but disappeared, and Sallie Mae was absorbed by the government.

Private securitized student loan debt (a Wall St business) has gone from $150B to $17B over the last 5 years. Wall St has pulled out of that business.

The federal government is the recipient of almost all interest on $740B of student loans, which by the way ballooned to over $1trillion almost immediately after the industry was nationalized. Oh, and as debt increases so do default rates; when loans default, or are forgiven by executive order, it is taxpayers who pay those bills.

How does Wall St. benefit from the ballooning student debt when it is almost all under federal government control?

Ballooning administrative costs are a true problem in higher education. The capital investments in facilities are due to an archaic model that will not survive in the 21st century. Financial institutions will always profit from loans to develop real estate. That is their business. The fact that universities are building more buildings in not driven by Wall St. Tuition has to rise to support these building projects and the principal is far larger than the interest. These projects do not help one more student get access to higher education, or make it more affordable so it is just an irrelevant upward pressure on prices to make the university experience nicer. The more projects you have the more administration you will hire.

When the federal government says they will pay for education the institutions that offer the education will naturally plan to invest more, hire more, expand more, and tuition will rise because it is not supported by market demand, but rather government appropriations and allocations.

This article is definitely a finger pointing effort to discredit the private sector of higher education and the arguments are filled with holes and lack a lot of relevant data points.

Charlie Eaton — July 9, 2014

Graham, Sallie Mae is not a government agency. It is a for-profit corporation that was fully privatized in 1997. Sallie Mae was never absorbed by the government.

Wall Street does benefit from the growth of federal student debt in that private financial firms are contracted as the servicers for federal student loans. That said, you are correct, that the federal government is the largest recipient of student loan interest payments. The federal government has provided student loans at much lower interest rates than Wall Street lenders, except for wealthier households with higher credit scores. But there is a strong case to be made that the department of education should provide loans at lower interest rates. Efforts to do this, however, were blocked by Republicans in Congress in 2013.

Wall Street also benefits from the growth of federal student debt in that federal student loans have been used to pay tuition for the exploding enrollment at for-profit colleges that are owned by Wall Street investors. Thankfully, profits are falling at many of these colleges in the wake of scandals around their scamming of veterans and underpriveleged students.

For more details, see www.debtandsociety.org.

Samantha Teeple — July 9, 2014

So the culprit behind rising tuition fees is "wall street" yet interest rates only account for 10% of student debt?

And this article isn't telling us anything new. We all know that loans have interest.

Something the article did mention that seemed like a probable culprit to me was universities and colleges taking out very large loans for building projects.

matt_black — July 9, 2014

This is one of the many symptoms of the huge borrowing binge the USA went on in 2008.

http://research.stlouisfed.org/fred2/graph/?g=Fhh

Ed McKinley — July 10, 2014

http://www.studentloanjustice.org/argument.htm

A Few Random Education Items – Bridget Magnus and the World as Seen from 4'11" — July 11, 2014

[…] Of course, not everybody makes it through college. Many drop out because they have trouble with the work, and many others drop out because they have trouble with money. Federal policies may make the latter worse. You know what might also be making things worse? Wall Street. […]

Five best ideas of the day - TIME — July 16, 2014

[…] 5. Is the bottomless thirst for Wall Street profits driving the soaring cost of higher education? […]

Gabriel Olofsson — May 23, 2022

I think Wall Street changed with the advent of cryptocurrencies. It would be interesting to see statistics on how many Wallstream traders trade or have investments in cryptocurrencies, I think it's around 70-80%. But they are not used to scams and it probably costs them, I don't think the stock market has trading robots like https://cryptodaily.se/bitcoin-profit-bot-recension/ that are only geared to cheat their users out of money.