Cross-posted at Montclair Socioblog.

We got another reminder last week that despite complaints about federal government programs that give money to the poor, when it comes to taxes, the government is much more generous to the wealthy. The news came from a report from the Congressional Budget Office on tax expenditures.

These are the ways that the government uses the tax system to give money to people. Some expenditures are tax credits, which can take the form of cash payments. Others are tax breaks — taxing people less than the going rate. For example, if I am in the 35% tax bracket, but the government charges me only 15% on the $100,000 I made playing the stock market, the government is giving me $20,000 it could otherwise have had me pay in taxes. That’s an expense. The preferential rate for my luck in the market costs the government $20,000.

The justification for these expenditures is that they are a way the government can encourage people to do something that it wants them to do. With tax breaks, the government is basically paying people by not charging them full tax fare — encouraging them to buy a house or give to charity or get health insurance at their work. Similarly with the tax credits that go mostly to the poor. We want people to hold a job and to care for their kids. The child tax credit gives people more money to care for their children. The Earned Income Tax Credit pays them for working, even at jobs that pay very little. By the same logic, the government is paying me to invest my money in companies — or put another way, to play the stock market.

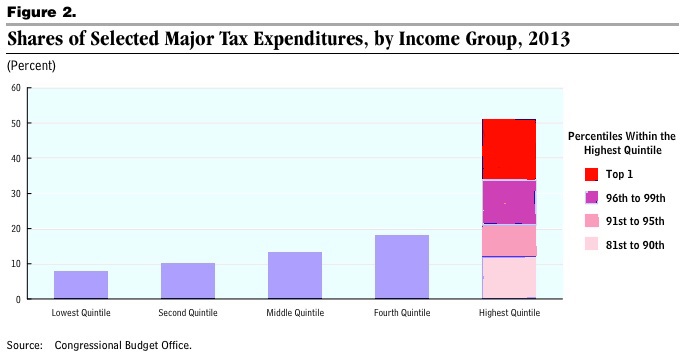

This government largesse, however, benefits some people more than others:

About half of all tax expenditures go to the top quintile (top 20% of income earners). The bottom 80% of earners divide the other half. And within that richest quintile, the top 1% receive 15% of all tax expenditures (this distribution of tax breaks roughly parallels the distribution of income). Were you really expecting Sherwood Forest?

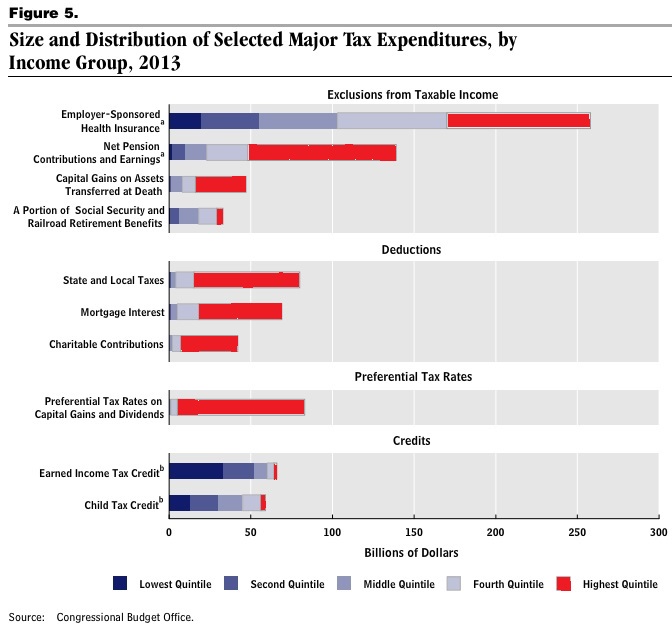

Here is a breakdown of the costs of these different tax expenditures:

The Earned Income Tax Credit, which benefits mostly the poor, costs less than $40B. The tab for the low tax on investment income (capital gains and dividends) is more than twice that, and nearly all of that goes to the top quintile. More than two-thirds goes to the richest 1%.

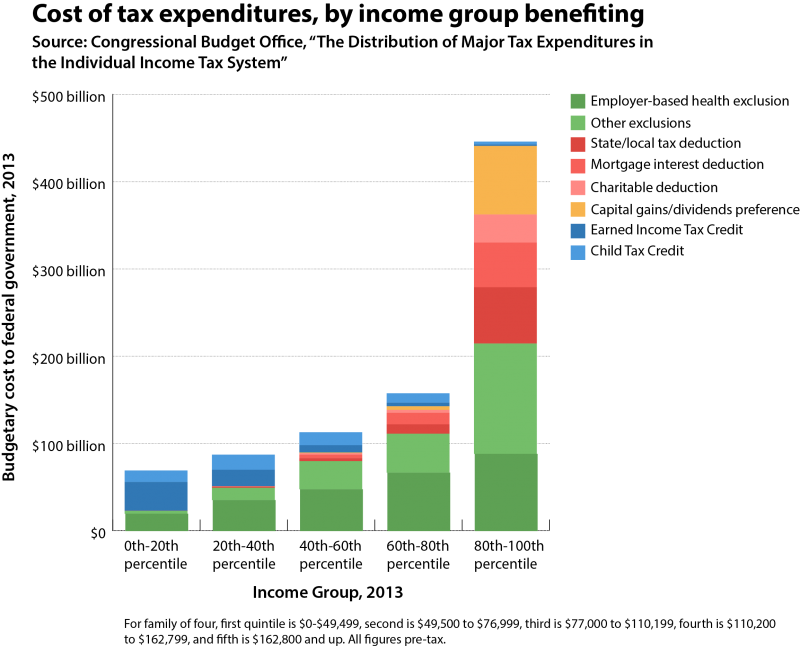

Dylan Matthews at the Washington Post WonkBlog regraphed the numbers to show the total amounts overall plus the amounts in each category for each income group:

The point? People complain about government payments to the poor, but tax breaks are also payments, though less obviously so, to the rich. And those tax breaks cost the government a lot more money.

Jay Livingston is the chair of the Sociology Department at Montclair State University. You can follow him at Montclair SocioBlog or on Twitter.

Comments 23

Felonious Grammar — June 11, 2013

And here is a chart for the effective tax rates for the highest income group from 1945 to 2010:

http://en.wikipedia.org/wiki/File:Effective_tax_rates,_US_high-income.png

Guest — June 11, 2013

because they contribute more to society duh can we stop having this conversation over and over

Vadim McNab — June 11, 2013

And how much do poor people pay or will (never) pay?

I do not believe in confiscating people's wealth just because we think they have too much money.

Maybe if more people would pay income taxes, civic participation in this country would be better.

Maybe if more people payed income taxes, there would be more action on the part of people to promote a healthy, effective government, one that wasn't dependent on wealthy people's lobbying.

We have to change the conversation on this old hackneyed topic.

Brutus — June 12, 2013

Should the discussion be expanded by including tax rates which increase with higher incomes? What about including the marriage subsidy/penalty?

One could suppose that the baseline of revenue was a head tax, and compare how much below average in taxes Americans with low incomes pay, but phrasing it that way would be the same injustice phrased the opposite way. It would be fair to consider what percentage of GPD total taxes are, and then determine what portion of income total taxes were for various groups.

Or at the very least, weight the 'expenses' of tax features against the income before those expenses from the same groups.

Gilbert P. — June 12, 2013

No one cares about old school (class warfare) sociology anymore, and those that do are anti apparently. Post about transsexual cunnilingus and you'll get 50 comments.

[links] Link salad wishes its parents a happy anniversary | jlake.com — June 12, 2013

[...] The Top 1% of U.S. Income Earners Receive 15% of Tax Breaks and Credits — People complain about government payments to the poor, but tax breaks are also payments, though less obviously so, to the rich. And those tax breaks cost the government a lot more money. [...]

Kevin — July 30, 2013

This article is misleading. The wealthy already pay over 90% of total government revenues from income taxes. why don't you show a chart of the total tax paid by each income class and the percentage this represents of total revenue. That really tells the story and directly conflicts with this author's message.

The Top 1% of U.S. Income Earners Receive 15% of Tax Breaks — August 29, 2013

[...] post originally appeared on Sociological Images, a Pacific Standard partner [...]

The Top 1% of U.S. Income Earners Receive 15% of Tax Breaks - Taxes-Info.com — August 30, 2013

[...] post creatively seemed on Sociological Images, a Pacific Standard partner [...]

A2Bookmarks Denmark — August 15, 2024

Jay Livingston, PhD, discusses a significant issue highlighted by a recent Congressional Budget Office report: the wealthiest 1% of income earners receive a disproportionate share of tax breaks and credits. This report reveals that the government allocates a substantial portion of tax benefits to the rich, contrary to the common perception that federal programs are overly generous to the poor. Tax expenditures, such as credits and breaks, are designed to incentivize certain behaviors by reducing the amount of tax owed. For instance, preferential tax rates on investments can lead to significant savings for high-income individuals, costing the government substantial revenue.

For those interested in staying informed about economic and tax-related issues, joining top social bookmarking websites in Denmark can be highly beneficial. These platforms provide a space to follow and engage with discussions on such topics, offering insights and updates from a variety of sources.