Cross-posted at Reports from the Economic Front.

How do corporations escape paying taxes? Businessweek recently ran a story on Google that helps to explain how they do it.

The story begins by noting that: “Google has made $11.1 billion overseas since 2007. It paid just 2.4 percent in taxes. And that’s legal.” This is pretty incredible because Google does business in many advanced capitalist countries with high tax rates. For example, “The corporate tax rate in the U.K., Google’s second-largest market after the U.S., is 28 percent.”

While the article focuses on Google, and how it avoids paying taxes, it made clear that most of the leading high-technology companies use remarkably similar techniques to achieve similar results.

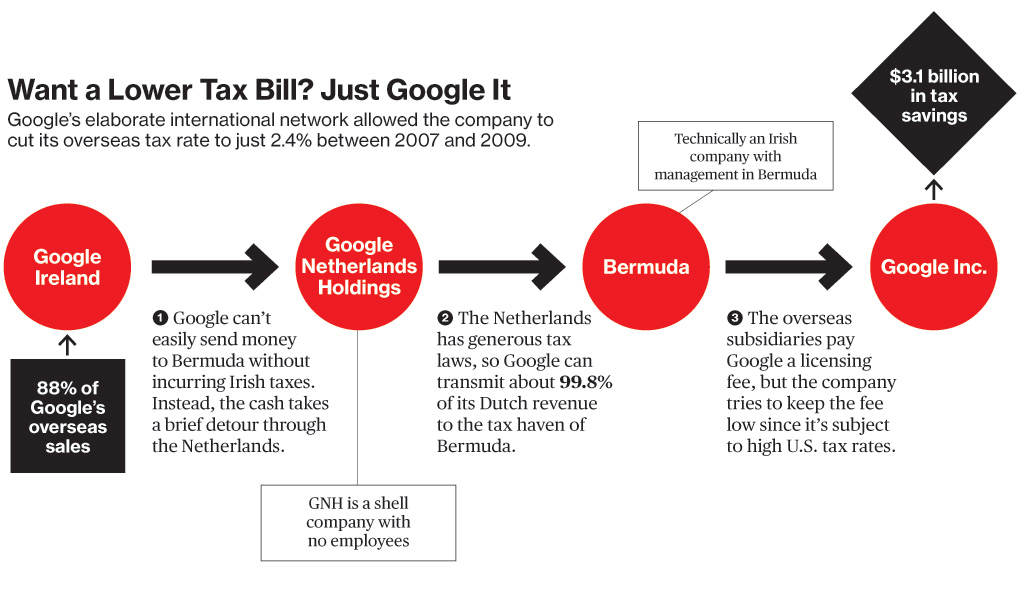

Ok, so how does Google do it? Google’s office in Ireland is the center of the company’s international operations. In 2009 it “was credited with 88 percent of the search juggernaut’s $12.5 billion in sales outside the U.S.” But Google doesn’t pay taxes on that amount, because most of the profits went to Bermuda, where there is no corporate income tax.

So, how did Google get its profits to Bermuda? Businessweek explains:

Google’s profits travel to the island’s white sands via a convoluted route known to tax lawyers as the “Double Irish” and the “Dutch Sandwich.” In Google’s case, it generally works like this: When a company in Europe, the Middle East, or Africa purchases a search ad through Google, it sends the money to Google Ireland. The Irish government taxes corporate profits at 12.5 percent, but Google mostly escapes that tax because its earnings don’t stay in the Dublin office, which reported a pretax profit of less than 1 percent of revenues in 2008.

Irish law makes it difficult for Google to send the money directly to Bermuda without incurring a large tax hit, so the payment makes a brief detour through the Netherlands, since Ireland doesn’t tax certain payments to companies in other European Union states. Once the money is in the Netherlands, Google can take advantage of generous Dutch tax laws. Its subsidiary there, Google Netherlands Holdings, is just a shell (it has no employees) and passes on about 99.8 percent of what it collects to Bermuda. (The subsidiary managed in Bermuda is technically an Irish company, hence the “Double Irish” nickname.)

This set-up (as Businessweek describes it) also helps Google lower its tax bill in the U.S. Google Ireland licenses its search and advertizing technology from Google’s headquarters in Mountain View, California. Obviously this technology is worth a lot—but Google headquarters keeps the licensing fee to Google Ireland low. Doing so means that Google headquarters can minimize its U.S. earnings and thus its tax obligations to the U.S. government. And of course, Google Ireland knows how to move its profits around to minimize its tax liabilities.

Not surprisingly, corporations are always eager to learn from each other. Thus, “Facebook is preparing a structure similar to Google’s that will send earnings from Ireland to the Cayman Islands, according to company filings and a person familiar with the arrangement.” Microsoft already has one in place.

According to one study cited by Businessweek (done by Kimberly A Clausing, an economics professor at Reed College), these kinds of profit shifting arrangements cost the U.S. government as much as $60 billion a year. And of course Ireland also loses plenty. Too bad that the governments of Ireland and the U.S. are suffering from large federal deficits and under immense pressure to slash spending. Collateral damage I guess to the profit-making drive.

What is being done to change this apparently legal racket? According to Businessweek:

The government has made halting steps to change the rules that let multinationals shift income overseas. In 2009 the Treasury Dept. proposed levying taxes on certain payments between U.S. companies’ foreign subsidiaries, potentially including Google’s transfers from Ireland to Bermuda. The idea was dropped after Congress and Treasury officials were lobbied by companies including General Electric, Hewlett-Packard, and Starbucks, according to federal disclosures compiled by the nonprofit Center for Responsive Politics. In February the Obama Administration proposed measures to curb companies’ ability to shift profits offshore, but they’ve largely stalled.

A nice cozy system, isn’t it.

Comments 28

Emil Begtrup-Bright — November 16, 2010

I know this trick - in my country, Denmark, the socialist-party "the red-green alliance" has been getting alot of credit for raissing the issue, since both McDonalds, Coca Cola, Nestlé and others uses this technique in order to escape taxes in Denmark.

Nothing happens though - the socialist party raisis the issue every couple of years, and then the social democratic party and the right wing cries out in moral outrage, but doesn't do anything about it...

Alice — November 16, 2010

Frankly, if I found a legal way to not pay taxes, I would do it in a heart beat. Not out of greed, but because I fundamentally disagree with a significant proportion of what those taxes are used for, and no existing government or legal system would allow me to have a direct say in it. I'm sure those aren't the reasons Google are doing it, but I can't say I'm too upset by it.

shale — November 16, 2010

What's most dangerous about this sort of arrangement is that there is practically no reversing it. If things had been regulated in the first place, companies would have managed their books and innovated where they had to, in order to make up the short fall.

Now, several years in, tightening up this law would have the effect of suddenly imposing a couple dozen percent tax increase.

pg — November 16, 2010

Nice to know that "legal" money laundering and ripping off the USA does not fall under Google's definition of "evil."

Who wants to organize a similar scam, I mean, scheme, for private citizens? "For 5% of your income, we will launder all the money you make through Ireland/Netherlands/Cayman Islands/Bermuda and you will only have to pay 2% taxes to the US government!"

How long would it take the economy to collapse?

Why aren't the "little guys" that pay 33% of their income in taxes upset about subsidizing the super rich this way?

AR — November 16, 2010

"What is a loophole? If the law does not punish a definite action or does not tax a definite thing, this is not a loophole. It is simply the law." ~Ludwig von Mises

gasstationwithoutpumps — November 16, 2010

I'm afraid that tax evasion through shifting money around for no reason other than to evade taxes falls under my definition of evil for businesses.

Simetra — November 16, 2010

One of the reasons why the "trickle down" effect is a sham. The buck stops at the top. The rich get richer and the poor get poorer.

I find it odd that more people aren't upset that their money (public funds) is essentially being stolen. Sure, Google is following the letter of the law, but they are obviously violating the spirit of the law.

Fernando — November 16, 2010

There is a difference in losing and not gaining. To lose something had to be yours in the first place.

decius — November 16, 2010

Reality check: This is refering, specifically, to Google taking money from countries outside the US, and not paying the US government for that.

When any individual who is a US citizen or permanent resident gets paid by Google, that person pays an individual income tax, or a capital gains tax, or evades the tax trhough personal income tax law. This is true even if the money is payed by 'Google Bermuda'. Whenever a citizen or permanent resident of any other country receives money from Google in whatever form, they are taxed or not taxed according to the laws of their country.

Pointing at Google's 'income' while ignoring how much of it is reinvested in its revenue stream is dangerous. Every salary that Google pays comes out of income, as is every bit of hardware they purchase, and a portion of the research required to build the hardware they will need.

A company in Vietnam purchases ad space targeting Germans looking at airfares to France. The ads are served from servers in several different countries. What country should tax that transaction?

Village Idiot — November 16, 2010

Imagine how things would be if former executives of major multinational and/or financial corporations somehow managed to get themselves appointed to top government positions involving writing, overseeing, regulating, and enforcing tax laws!

If that ever happened I'd bet the global financial system would suffer vast and irreparable damage that would mainly be felt by those who didn't have much money in the first place. At the same time, the people riding at the front of the corporate Gravy Train would reap enough profit to cause a disparity of wealth among the world's population wider than any before seen in history.

But to distract the masses from the slow-motion suicide of civil society those developments would cause, I'd bet that those holding economic and political power would roll out the tried-and-true "bread and circuses" routine, but with a modern twist (it'd probably be more like "pizza and reality TV" these days, with TV focusing on increasingly-sordid spectacles of sex and violence). I'd also expect to see a steady increase in 'circuses' as we began to run out of 'bread.'

It sure would be unfortunate if any of that were to happen...

Only the little people pay taxes « Creon Critic — November 18, 2010

[...] Helmsley’s notorious remark fits the world of corporate tax avoidance well. Sociological Images highlights a BusinessWeek article outlining a particular scheme multinationals employ to avoid billions in US [...]

matt — November 19, 2010

Isn't this a good reason to do away with corporate taxes altogether? Why force a tax on an intangible entity? Shouldn't we be taxing the people that benefiting from the profits this company makes?

In google's case, the people benefiting most would be the shareholders. I'm not sure what their shareholder breakdown is, but I'd imagine that a significant portion of it (being a publicly listed company) is held by ordinary joe blow (either directly or indirectly).