The Dynamics of Debt in Young Adulthood

In any newspaper or blog these days, you’re bound to find human interest stories of fresh-faced young adults, newly independent from their parents, and saddled by a mountain of debt they can’t even dream of repaying. The media narrative—think the white college student plagued by $120,000 of student loan and credit card debt—often borders on hyperbole. It skews the reality of how much debt the typical young adult owes.

And while youth indebtedness has received rampant media coverage, there’s been very little solid research tackling this emerging social problem. Evidence from a small group of researchers examining how youth debt has changed over time, how youth indebtedness is linked to social stratification and inequality, and the consequences of debt for young people as they advance through their adult lives can give us a glimpse. The research in this area is nascent, and some of it is contradictory, in large part because access to credit and debt carries an array of costs and benefits, and is influenced by social and structural factors, such as race, class, and education. Debt can surely open doors and create access, but it can also close doors by imposing a long-term burden for debtors and their families.

Three Generations of Debt

Over the past fifty years, the period known as the “transition to adulthood” has changed dramatically. In the 1960s and ‘70s, young people left the parental home, completed education, got married, and had children, in a relatively quick and orderly fashion. Today’s transition to adulthood is much more complex. Young people are extending their education, delaying marriage and childbearing, and some return to live with relatives. They enter and exit college, cohabitate rather than marry, and take longer periods for “self-discovery” if they are able. While youth must now navigate this increasingly complex transition, they also take on unprecedented financial risk. Whether in the pursuit of a college degree, getting married, buying a home, or simply paying bills and making ends meet, young adults often assume great deal of debt as they leave the nest and set out on their own.The rise of debt in young adulthood has been driven by a potent mix of policy changes, rising costs, and stagnating incomes. On the supply side, young adults have come of age in an era of easy access to credit. Financial deregulation in the 1970s and ‘80s increased the supply of credit and made debt an extremely profitable business for banks. It was aggressively marketed toward consumers—particularly young adults—which led to a massive increase in household debt and problems with repayment. On the demand side, rising costs—such as the skyrocketing price of college—make credit an appealing option. Since their parents already have debt, young people must take on debt of their own.

In a recent study for Social Problems, I used data from the National Longitudinal Surveys to show how debt has changed across three generations (what we demographers refer to as “cohorts”) of young adults. I focused on people in their mid-twenties—The Early Baby Boomers, who were young adults in the late 1970s; The Late Baby Boomers, who were young adults in the late 1980s; and Generation Y, who are currently in their twenties.

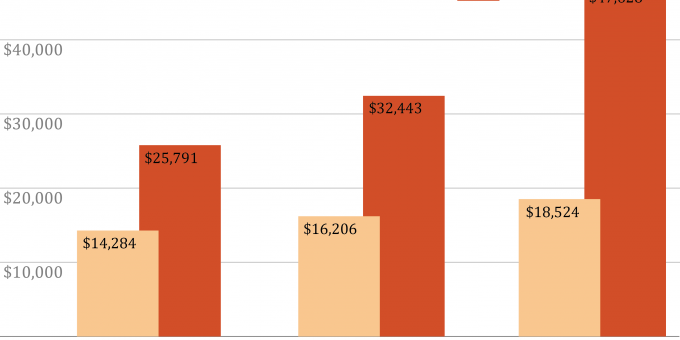

The graphic below confirms what most laypersons and media reports have suggested—debt has risen. I show mean and median total debt across three cohorts of young adults, adjusted for inflation and basic sociodemographic factors such as socioeconomic status, race, and age. Total debt is the sum of everything from home mortgages, credit cards, and student loans to automobiles and personal loans. Comparing mean and median debt across cohorts, we notice the mean has increased much faster than the median. While the median gives us a good sense of debt in the middle of the distribution, the mean is far more sensitive to extremely high and extremely low debt loads. What this reveals is that much of the growth in debt across cohorts is being driven by an increase in the number of severely indebted young adults. In some ways, it seems the media imagery of the young person beleaguered by extremely high levels of debt is more commonplace today than it was thirty years ago.

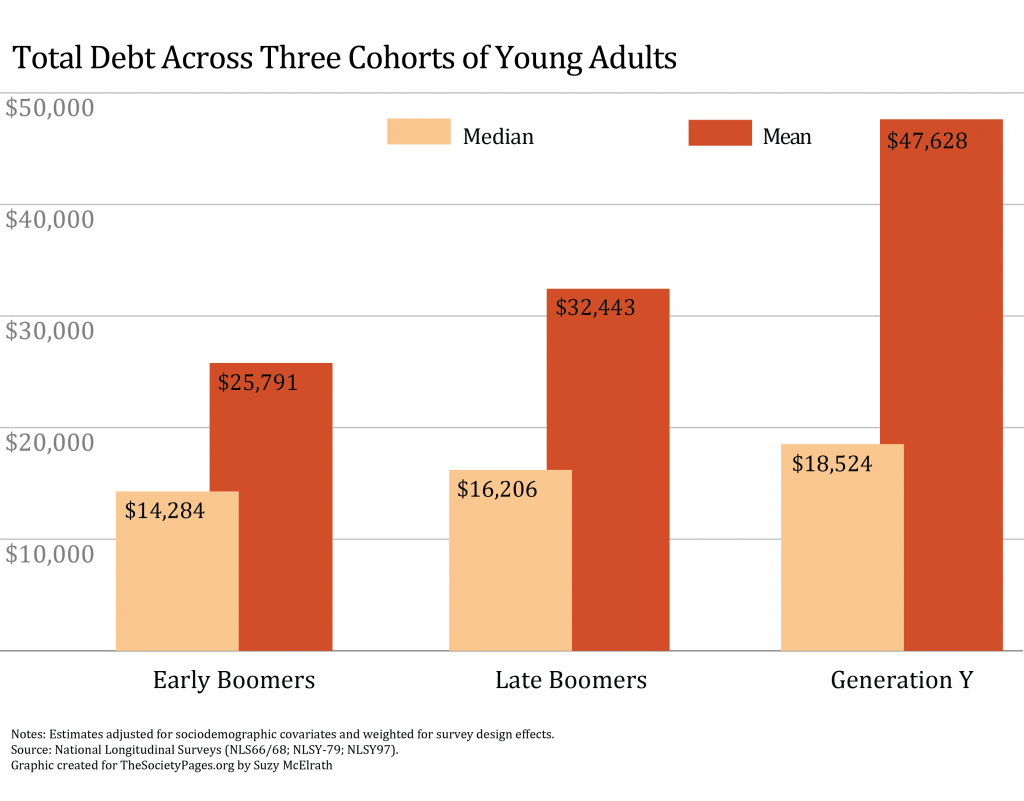

A focus on total debt, however, obscures how difficult it is for youth to actually repay what they’ve borrowed. For example, we may not be concerned about rising debt if the means to pay down that debt were rising at the same pace. In the second figure (below), I show two standard measures of debt burden, or debt relative to economic resources, that indicate how difficult it is for young people to pay off debt. Debt relative to assets (debt-to-asset ratio) and debt relative to income (non-mortgage debt to income ratio) has increased considerably across the three cohorts. The debt-to-asset ratio is particularly high for Generation Y, suggesting that the median young adult household would have to liquidate 71% of their assets to pay off their outstanding debts. In addition to facing higher amounts of debt than the cohorts that came before, the Generation Y cohort is more likely to be trapped in debt.

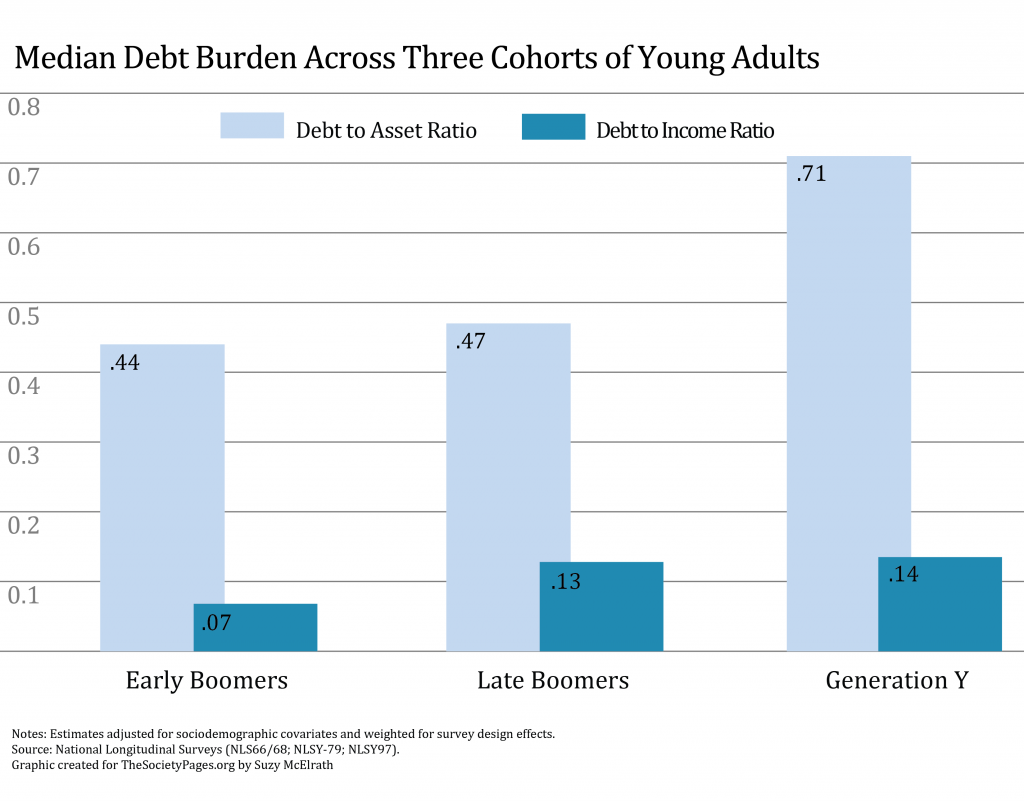

While indebtedness and debt burdens generally increased across cohorts, so too did the types of debt young adults take on. My final figure shows how credit use in young adulthood has changed. For the Early Boomers, home mortgage debt dominated. Across cohorts, student loan debt has replaced home mortgage debt as the primary form of wealth-building debt. Credit card debt has also become a more visible part of the household balance sheet. In some ways, these changes in credit use across cohorts reflect the broader structural shifts in the transition to adulthood I wrote about in the beginning. As young people have extended their education and delayed family formation and entry into adult roles, they have moved away from debt that signals entry into traditional adult roles, such as home ownership, and toward debt that signals the evolving needs of young people and rising access to credit, like student loan and credit card debt.

These changes in credit use have varied tremendously across social class lines. Across cohorts, young adults from less advantaged backgrounds (low income, less educated parents) and those who lack a college degree are disproportionately taking on unsecured debt (the kind that isn’t tied to an asset like a house or a car). Meanwhile, across cohorts, college-educated youth and those from more advantaged social class backgrounds have taken on more wealth-building debt, especially education loans. This growing disparity in debt portfolios suggests that, in the latest generation of young adults, the more advantaged are able to take on debt that helps them pursue a middle class lifestyle and build their wealth, while the less advantaged must take on debt to pay their bills and keep their heads above water. This raises a big question: what is the role of debt in maintaining or alleviating social inequality?

Debt: The Great Equalizer or Perpetuator of Inequality?

A core question for sociologists is how the rise of credit and debt is linked to social stratification and inequality. On the one hand, access to credit may have afforded many opportunities—such as a new home or a quality education—that would otherwise be out of reach. On the other, debt may serve to reinforce or exacerbate existing inequalities by race and class, overburdening some groups with debt that they cannot hope to repay.

Most of the research on this issue has focused on student loans, which have provided many with access to a college degree. As sociologists have long known, getting a college degree is central to upward social mobility and is, for many, a vital pathway to the American middle class. But because of uneven access to higher education, student loan availability may maintain certain inequalities, affording opportunity for some, but not all potential students.

For young adults, it isn’t yet clear whether student loan debt is providing opportunities or reinforcing inequality, though it is clear that debt breaks along social class and racial lines. In a recent study in Sociology of Education, I found that parents’ education, income, and race are strongly predictive of the amount of student loan debt acquired among young adults who attend postsecondary institutions. Specifically, young adults from lower-middle income and less educated backgrounds have a significantly higher risk of carrying student loan debt in young adulthood than their more affluent counterparts. Moreover, African Americans have considerably more debt in young adulthood than their white counterparts, which may reflect the overarching legacy of disadvantage faced by African Americans. When we consider that young adults with excessive debt are at a greater risk for dropping out of college, defaulting on their loans, and entering bankruptcy, student loan debt looks more like a perpetuator than a panacea for inequality.On the flip side, some research suggests that, at modest levels, student loan debt could help alleviate educational inequalities. For example, low levels of student loan debt—up to $10,000—actually reduce the risk of college dropout. Perhaps that number is about enough debt to make staying in college seem worth it, but not so much that the student feels hopeless before ever getting to graduation. Related research shows that, despite the fact that black students have higher levels of student loan debt than whites, debt increases enrollment and persistence in college among African Americans. However, this same work shows that high levels of student loan debt ($15,000 or more) can increase the risk of dropping out of college. Though debt may increase college access, as some young people take on more debt, they begin to feel overburdened and many leave without a degree.

Indeed, more and more students do leave college with debt but no degree. This shows how going to college is a greater gamble for young people today than it was in the past. In the 1960s, those who dropped out of college had little or no debt and could enter a strong labor market with access to decent-paying, middle-class jobs. Today, those who leave college without a degree are largely unable to acquire middle-class jobs and may feel doomed to their debt. Indeed, in Katherine Porter’s groundbreaking study on middle-class bankruptcy, she found that student loan debtors who drop out are at particularly high risk of declaring bankruptcy since they struggle both to make ends meet and keep up with loan payments. This is in spite of the fact that bankruptcy does not discharge education debt. A recent report in the Chronicle of Higher Education demonstrates that bind: default rates are rising among student loan debtors.

The story of student loan burdens is consistent with the narrative that debt has both costs and benefits for young people—what sociologist Rachel Dwyer and colleagues call a “double-edged sword.” It is both a borrowed resource that can bridge the gap between rising college costs and lower parental resources, but it is also difficult to repay, especially for those students who don’t finish a degree.

Consequences of Debt in Young Adulthood

This idea that debt is a “double-edged sword” for young people is also apparent in some important new studies on how debt affects young people’s economic, social and psychological well-being. This research suggests that debt’s benefits become detriments once payment comes due. For example, Dwyer and colleagues found that having student loans and credit cards led some young people to feel empowered and in greater control of their lives; it opened freedom and possibility. But these effects wore off as young people grew older and started to repay the debt they accrued along the way. Debtors in their mid to late twenties tended to feel they had less “control over their lives” and lower levels of mastery. Similarly, debt burden is linked to increased anxiety and depression, suggesting that rising debt is undermining the mental health of young people, at least once the bills show up.

The long-term effects of a heavy debt burden spread across a wider swath of young Americans is a big, unanswered question. When we ask young adults if they feel like debt is holding them back, many say it prevented them from going for a job or internship they wanted and made them think twice about getting married, buying a home, or having a child (some of the traditional “markers” of adulthood). The research, however, is mixed on this topic. Looking at earlier cohorts of twenty-somethings, scholars have found little evidence that debt impacts choices and well-being, but more recent Generation Y research by Fenaba Addo shows a shift, suggesting that credit card and student loan debt may be leading young women to favor cohabitation and delay marriage.In the media, the concern focuses on the constraint of young adults’ choices and far-reaching impacts on the economy. Some outlets believe student loan debt is slowing down the housing market recovery, as over-indebted young people decide not to buy homes, or are unable to qualify for home mortgages due to their high debt levels and low credit scores. Again, the actual research is less convincing. For instance, Lawrence Berger and I found that young adults with student loan debt are somewhat less likely to purchase a home and purchase less expensive homes than similar young adults without student loans. These differences were quite small, though; it is highly unlikely that student loan debtors are dragging down the housing market or holding back its recovery.

So, while news headlines sometimes paint a hyperbolic picture of young debt, sociological research is beginning to give us a more nuanced view. In order to participate in society and gain economic independence, many young adults today must take a massive financial risk. It’s a gamble—a roll of the dice for their future. For some, this gamble may pay off: that line of credit may help them graduate from college, attain their dream job, and live happy fulfilling lives. But others will find themselves buried under a mountain of debt with little to show for it and even less hope of repayment. In an era of credit expansion, rising prices, and stagnating wages, debt is now an integral part of social life for young adults, and we can’t paint it as “good” or “bad,” at least not yet. But, it is clear that debt accumulation isn’t just about personal or financial irresponsibility, as some would lead us to believe. Instead, the rise in debt is strongly tied to historical, social, and structural factors, and debt among today’s young adults mirrors existing class and racial divides. Though it is too soon to know, it may well be that debt will come to play an important role in the maintenance and reproduction of socioeconomic and racial inequalities across generations. The big picture is, perhaps, bleaker than any one sad story.

Recommended Reading

Rachel E. Dwyer, Laura McCloud, and Randy Hodson. 2011. “Youth Debt, Mastery, and Self-Esteem: Class-Stratified Effects of Indebtedness on Self-Concept,” Social Science Research 40:727-741. Examines the positive and negative impacts of debt on youth well-being.

Rachel E. Dwyer, Laura McCloud, and Randy Hodson. 2012. “Debt and Graduation from American Universities,” Social Forces 90:1133-1155. Investigates how debt accumulation impacts the risk of dropping out of college.

Randy Hodson, Rachel E. Dwyer, and Lisa A. Neilson. Forthcoming 2014. “Credit Card Blues: The Middle Class and the Hidden Costs of Easy Credit,” The Sociological Quarterly. Shows that the onset of the great recession and rising debt negatively impacted the mental health of young adults.

Jason N. Houle. Forthcoming 2014. “A Generation Indebted: Debt in Young Adulthood Across Three Cohorts,” Social Problems. Examines how debt has shifted across three cohorts of young adults in the ‘70s, ‘80s, and 2000s.

Brandon A. Jackson and John R. Reynolds. 2013. “The Price of Opportunity: Race, Student Loan Debt, and College Achievement,” Sociological Inquiry 83:335-368. Examines racial inequalities in debt accumulation, college persistence and student loan default.

Comments 7

Letta Page — March 12, 2014

At age 34, I'm just on the cusp of paying off my last student loan. I earned my master's degree in 2001. My husband, who has a PhD, will not yet have paid off his federal loans by the time he becomes eligible for the Public Service Loan Forgiveness Program (http://studentaid.ed.gov/repay-loans/forgiveness-cancellation/charts/public-service) in October 2017. He'll be 43.

Friday (err, Sunday) Roundup: March 16, 2014 » The Editors' Desk — March 16, 2014

[…] “Out of the Nest and Into the Red,” by Jason N. Houle. Three generations of debt reveal changing ideals and life courses. Oh, and debt. […]

Is Massive Financial Risk the New Recipe for Success? Millennials and Debt » Sociological Images — March 18, 2014

[…] carry more debt than their parents and grandparents did at their age? Yes, according to a new study by sociologist Jason Houle. ”In order to participate in society and gain economic […]

Jennifer Heneghan — March 18, 2014

My first thought when looking at this article was- why did he leave out Generation X? Then I looked at the data he used and realized that it was because the survey was never done on Generation X. Seeing as how a lot of the problems Millenials face were/are also experienced by Generation X (if not quite as extreme) I have to question the validity of this study's conclusion that things are suddenly so different. It seems to me that this is more of an evolution over time and the result of conditions that did not begin during the Milennials' lifetimes. I wish he would have used a more complete data set and included information on that generation as well so we could have a more accurate picture of the changes over time.

Climber13 — March 21, 2014

Interesting report. I find the increase in young people with debt who don't actually finish college particularly troubling. Dropping out of college was never a great idea but, with the current debt situation, it can be much more catastrophic.

A PATH TO MOBILITY? How universities maintain the class structure - Sociology Toolbox — March 1, 2016

[…] A recent article by Jason Houle, examines the differences in student loan debt across different levels of parental socioeconomic status (SES). He finds that students from high-income families have 240% less debt than students from lower-income families. The more educated their parents are, the less debt that students accrue – those with at least one college-educated parent have 54% less debt than those students with neither parent holding a college degree. Among those that have very high levels of student loan debt, “those from low-income and less educated backgrounds are more likely than their more advantaged counterparts to take on very high levels of debt” (62). Read more about student loan debt from Jason Houle on the Society Pages here. […]