This CollegeHumor parody eTrade ad has been making the rounds. In light of the recent stock market “correction”, what is underscored is there is a two-tiered market, as Jon Stewart claimed when he had Jim Cramer on The Daily Show in 2009—one for the powers that be and one for the rest of us. Economic sociology blasts apart the naïve assumption that markets have “atomized” agents guided by rational choice. There are embedded social networks and institutional factors that create information asymmetries, with the deck stacked in favour of those “in the know”. The individual investor and those relying on the market through defined contribution plans, IRAs, etc. for their retirements might relate to this parody ad far too well. Oh, how we should long for the days of the defined benefit pension.

As an aside, as one who has ditched the ivory tower for navigating the entrepreneurial waters, I can say one thing that I knew all along, but is abundantly clear in so many ways—the system is geared towards business and doors open that are closed to individuals, save for those with great means.

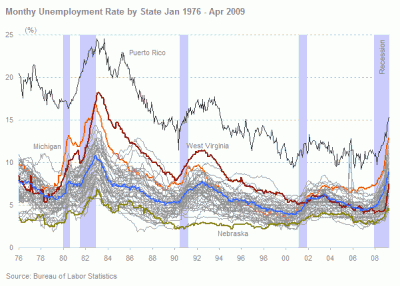

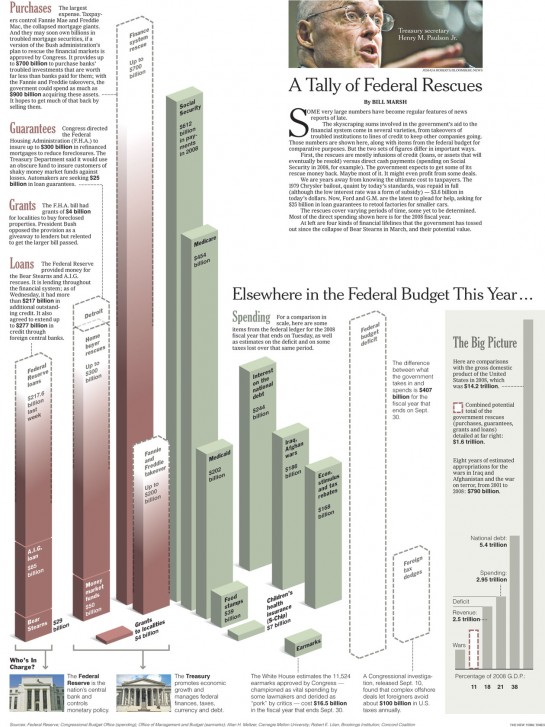

In light of the threat of the “r” word—recession, it’s easy to second-guess the “jobless recovery” and US economic policy aimed at bailouts {Obama style} and propping up the capital markets. While corporations are better off than they were three years ago, they have grown accustomed to sitting on cash and extracting more out of the labour force because it’s a buyers’ market. The unanimous consensus is that the economic indicators aren’t rosy and the prospects for US GDP growth are dim. The political focus on deficits is the last thing that the economy needed.

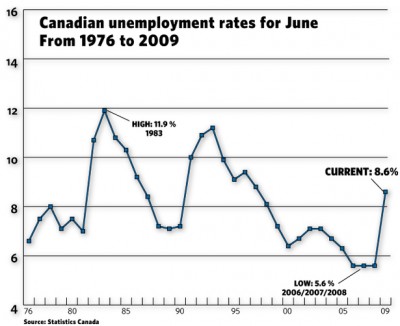

Was the stock market yet another bubble that’s about to burst? Canada’s housing bubble should cause worries, as well, as Canadian unemployment is still relatively high. Of course, Canada’s Finance Minister, Jim Flaherty, refuses to acknowledge there’s a housing bubble, hoping the Canadian economy grows out of any and all predicaments, which is exactly what Obama, Geithner, et al were hoping from day one.