Good jobs, that is. Not to be a cassandra, but I have concerns about the structure of the economy. History has shown that the high standard of living in late-Renaissance Venice wasn’t sustainable [*]. While the relatively expensive goods of Venice were often of high quality, cheaper, mass-market goods produced in Britain, France, and the Netherlands were gaining in popularity. Will the US suffer from the same fate? In other words, are the high wages and standard of living in the US sustainable, economically? Robert Reich has a gloomy outlook on his blog::

“But here’s the real worry. The basic assumption that jobs will eventually return when the economy recovers is probably wrong. Some jobs will come back, of course. But the reality that no one wants to talk about is a structural change in the economy that’s been going on for years but which the Great Recession has dramatically accelerated.

Under the pressure of this awful recession, many companies have found ways to cut their payrolls for good. They’ve discovered that new software and computer technologies have made workers in Asia and Latin America just about as productive as Americans, and that the Internet allows far more work to be efficiently outsourced abroad.

This means many Americans won’t be rehired unless they’re willing to settle for much lower wages and benefits. Today’s official unemployment numbers hide the extent to which Americans are already on this path. Among those with jobs, a large and growing number have had to accept lower pay as a condition for keeping them. Or they’ve lost higher-paying jobs and are now in a new ones that pays less.”

I think he might be on to something and I tend to be an optimist. If this were 1992, I’d say we’re going to grow out of the recession the US was in back then. Innovation, efficiency, and productivity increases would be part of the upswing in the ever-present business cycles. But, are we in a different economic situation? Have we maxed-out efficiency? What about innovation? Will we still be competitive in that arena?

I have two main concerns. One is of industrial organization and the other is of income inequality, which I believe are inter-related.

- Industrial organization. In the US, smaller businesses are expected to create the most new jobs, but the deck is stacked against them, which is also a political and policy issue. There’s a pressure towards increased scale and size. Larger enterprises may be more efficient, but often are less innovative, categorically, due to constraints on “dynamic capabilities” {ability to innovate, learn, or continuously reposition itself more effectively than its rivals} and disincentives in the form of disruptions to current income streams {e.g., pharmaceuticals selling several profitable on-patent drugs in a category of drugs having little incentive to develop and market a “cure” for a particular disease in a new category of drugs. Hence “incremental” innovations of slight modifications and new patents based on them.}

- Income distribution. I feel that over time, the pressure towards increased the scale of organizations will put downwards pressure on wages and the standard of living for most employees. Why? If industries are dominated by a few players there will be a tendency towards oligopsony {few “buyers” and many “sellers”} in labour markets. Employees will have less bargaining power because the few employers will tend to tacitly collude. If global competition inhibits growth, there will be further pressure to cut wages and/or outsource.

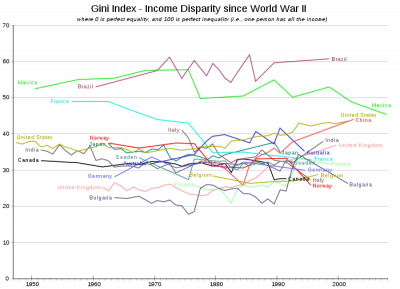

The feather in the US’s cap is human capital talents and a large skilled labour pool, but these matter the most in innovative and high value-added firms. If the US starts to lose its innovative edge, there will be less demand for skilled workers and managers. More income inequality. While hardly definitive, the gini coefficient measures this::

In the US, the gini is on the rise, indicating a growing gap between the wealthy and poor. What would be really telling is to examine what’s happening to the middle class over time, i.e., the shape of the Lorenz curve}. I think for the vast majority of Americans, there may be more diminished expectations in store. The top 2% have no worries.

So, I agree with much of what Reich has to say. The goal isn’t just jobs, but good paying ones. In my opinion, part of this in the private sector {as opposed to public sector efforts, such as stimulus spending} is more basic R&D that fuels innovation and more entrepreneurship, which will require policies to support it.

Twitterversion:: #RobertReich blogs on jobs in US. Given his take, are big firms&lack of innovation a big part of problem? #ThickCulture http://url.ie/3f80 @Prof_K

Song:: The Bleeding Heart Show-The New Pornographers

Comments 2

Frank Leibold, PhD — July 25, 2010

Where Are The Jobs:The Untold Story Behind The Jobless Recovery?

Frank B. Leibold, PhD.- July 25, 2010

Increasingly newspaper headlines across America are asking this question.

Almost 18 months ago the $862 billion stimulus bill was passed by congress. The Obama administration claims that 3.5 million jobs have either been created or saved although neither can be substantiated. Yet since its passage another 3 million Americans have lost their jobs! Today we remain at a 9.5 percent unemployment rate-15 million people counting those who can only find part-time work- and the Department of Labor's DLS indicates that there are six job seekers for every available job and 46 percent of those unemployed have been for more than six months – both all time highs. Just this week new unemployment claims were 464,000. To date it has truly been a jobless recovery!

I believe the US economy has 'absorbed' the current underemployment level through innovation, re-structuring and productivity gains. With 70 million baby-boomers yet to retire the workforce is at its performance peak to have accomplished this. In my view these 15 million jobs are structurally gone and will not return as the economy rebounds!

Yet there is a more important issue facing future job seekers and the US economy that could significantly worsen employability opportunities.

America's Global Skills Gap

“The skills gap is one of the most pressing issues facing America’s workforce. Whether the baby boomers choose to retire at the projected rate or not, both situations will require a significant re-skilling of the workforce. The learning profession must take action on the skills gap in order to ensure the readiness and competitiveness of its workforce. Frank has carefully researched the skills gap in his new book. It’s an important read for a greater understanding of the issue and what we need to do about it.”

—Tony Bingham, President & CEO, American Society of Training and Development

Many American companies find themselves ill-equipped to grow because of a lack of skilled workers according to a 2005 report by the National Association of Manufactures (NAM) “The Growing Skills Gap.” And the skills gap is also not just a large manufacturing company problem. A 2002 US Chamber of Commerce report, Keeping Competitive, indicates that 73 percent of surveyed small companies with less than 50 employees are experiencing “severe” or “very severe” problems in hiring qualified workers and that 40 percent of all job applicants had “poor or no employment skills.” The US Conference Board (CB), American Society of Training and Development (ASTD), the Society of Human Resource Management (SHRM), President's Council on Competitiveness (COC) and the National Center on Employment and the Economy (NCEE), among others, have documented a widening global skills gap over the past 25 years.

In the near future skills defined as critical thinking, creative problem solving, communication and collaboration (the four Cs) will become even more important to organizations according to a new survey conducted by the American Management Association (AMA) released in April 2010. The AMA recommends that public education merge the four Cs with the traditional three Rs in its curriculum as their members acknowledge the global skills gap.

The cause of these deficiencies is clearly due to a failed US public educational system. In 1989 US Secretary of Education Lauro Cavazos indicated “There are three deficits; the trade deficit, the budget deficit and the educational deficit. The first two can’t be resolved until we overcome the last.”

In 1999 The President’s Council on Competitiveness said it best: “The skill gap among American workers is out pacing the growth of workers, companies and the educational system’s ability to deal with it.”

Unfortunately future trends threaten to worsen the gap. The productivity loss of 70 million retiring “baby-boomers” with their expertise and educational levels, the drastic increase in diversity- half the workforce will be people of color by 2028 and the accelerating trend towards an increasing number of careers and job changes (“boundaryless” careers), to name a few. America's economic dominance over the past half-century is also coming to an end as we lose our scale, education and innovation advantages. President Obama recently acknowledged this as he indicated “no longer can the world depend on America to drive global economic recovery.”

Most Americans are unaware of this growing threat to our standard of living which will affect all citizens. Its dissemination has primarily been among those professional organizations attempting to ameliorate the problem and those companies who are feeling its negative global competitive impact. This lack of public awareness is troubling to me for I believe that any solution must start with strong national support. I hope political considerations haven't shielded the public from this prolonged national weakness?

This is why I wrote the soon to be published book The Key To Job Success In Any Career. My eight years of research have led to the six Lifelong Transferable Competencies (LTCs) discussed below – which have been scientifically validated by over 40 sources from multiple disciplines. The book provides assessment measures to determine competency mastery. A LTC model is depicted and explained and over 60 suggestions are offered so readers can develop their own LTCs and improve their employability skills in the process. After analyzing the failures of the past 25 years to close the gap the book proposes eight doable recommendations – both short and long term – to start the nation on a final path to resolving this persistent, vexing and damaging problem.

The following LTCs are required for any occupation or career and most levels of responsibility. Four were mentioned, although not stressed, in1992 by ASTD, the Secretary of Labor's Commission on Acquired Necessary Skills (SCANS) and the National Skills Standards Board (NSSB). Transferable skill-sets or competencies have become the new currency for success, future employability and closing America's global skills gap.

The Six LTCs

To succeed today one must be driven by satisfying the changing customer's or client's needs. Your customer may be either external or internal. All organizations need effective and efficient problem solvers who can utilize technology to meet the customer's need in a response time that provides a sustainable competitive advantage through added comparative value and service. In order to perform effectively in an increasing multicultural society it is important to have a global perspective with cultural understanding and sensitivity. One must also be motivated and persistent for the right reasons; realizing that you can increase your motivation substantially to face unforeseen future challenges. The root of all effective motivation is a healthy amount of self-esteem. Managing your career to have multiple and varied job assignments, including an international position, will help develop the needed competencies. A formal career plan, along with feedback from candid and trusted friends for realism, and a mentor to assist you in navigating career moves is also critical. Finally, living a balanced and healthy life with time devoted to family and outside work activities is now recognized as essential to life and career success.

Stating it differently, you satisfy your customer's changing needs by anticipating them and then providing a competitive responsiveness with the best comparative value by usually solving value chain problems in a multicultural team-oriented workforce. In order to accomplish this, you will need cultural understanding to be an effective team contributor, manage your career to acquire the needed skill-sets (marketing, problem solving, cultural understanding and facilitation), lead a balanced and healthy lifestyle for the required focus and energy and finally possess the requisite motivation to accomplish all the above. So the LTCs developed are interrelated and work in a process that when followed will result in employees who will not only improve their employability but will begin to start closing America’s global skills gap.

Summary

Despite the job stimulation legislation last year the slow and unsteady economic recovery has been jobless. Some claim that the uncertainties of new medical and financial legislation have prevented companies from spending an estimated $1.9 trillion in capital they are withholding. Others point to jobs moving to lower wage rate countries. Both factors are contributors. However it should be clear to all that tomorrows job creation could be hampered by America's workforce skill deficiencies and it will require new competencies that help to close America's global skills gap.

“The Conference Board's research confirms that American business finds new entrants to the workforce lacking in the skills required to be globally competitive both today and for the demands of the coming years. Frank Leibold, in his new book-“Competencies That Close America's Global Skill Gap”- recognizes and analyzes this deficit and offers individuals specific guidance on how to overcome these skill gaps. His advice is important for those just entering the workforce who may find they need skills heretofore unlearned. However, his advice may be even more critical for those more seasoned workers who are challenged by having to reinvent themselves in this new economic reality, where companies are requiring employees to take on more responsibility for their personal and professional well-being?”

-----Mary Wright, Project Leader, Workforce Readiness Initiative,The Conference Board

-----------------------------------------------------------------------------------------

Frank Leibold after a distinguished 30-year business career with three multinational corporations-culminating in the position of Group President re-tooled himself and obtained his Ph. D.. Frank then became a nationally recognized university professor of marketing while founding his own global management consulting company. He and his wife reside in South Carolina and spend time traveling to visit and spoil their nine grand-children–two in Australia. His new book The Key To Job Success In Any Career:Developing Six Competencies That Close America's Global Skills Gap will be published by Outskirts Press in October 2010 – excerpts from which this article was developed.

Will Richardson — December 28, 2010

You could do worse than check out Modern Monetary Theory proponents such as Warren Mosler, Bill Mitchell along with the Job Guarantee idea