Originally published on March 28, 2016.

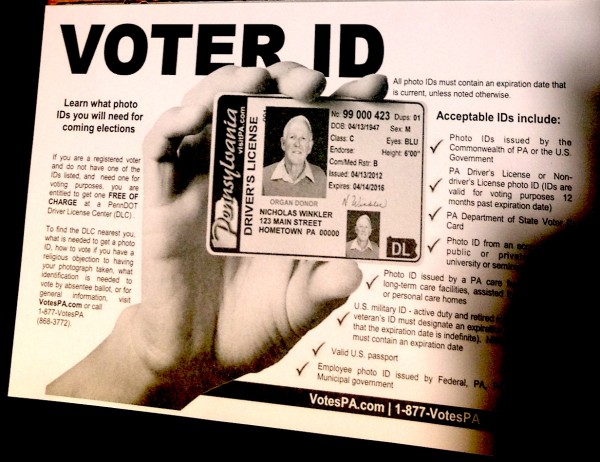

Strict voter identification laws are proliferating all around the country. In 2006, only one U.S. state required identification to vote on Election Day. By now, 11 states have this requirement, and 34 states with more than half the nation’s population have some version of voter identification rules. With many states considering stricter laws and the courts actively evaluating the merits of voter identification requirements in a series of landmark cases, the actual consequences of these laws need to be pinned down. Do they distort election outcomes? more...

Research to Improve Policy: The Scholars Strategy Network seeks to improve public policy and strengthen democracy by organizing scholars working in America's colleges and universities. SSN's founding director is Theda Skocpol, Victor S. Thomas Professor of Government and Sociology at Harvard University.

Research to Improve Policy: The Scholars Strategy Network seeks to improve public policy and strengthen democracy by organizing scholars working in America's colleges and universities. SSN's founding director is Theda Skocpol, Victor S. Thomas Professor of Government and Sociology at Harvard University.