The foreclosure crisis that emerged in 2006 continues to displace families and change neighborhoods, creating holes in the social fabric of communities. Kathryn Clark, artist and former urban planner, has created a series of “foreclosure quilts” based on maps of urban areas, with holes representing foreclosed houses. These unique visual representations call our attention to the holes that remain after foreclosure.

Clark writes on her blog:

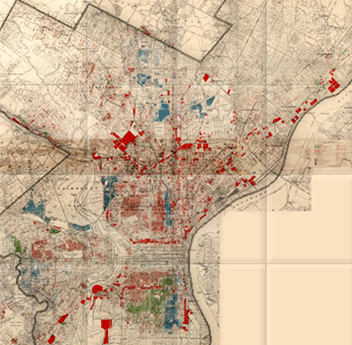

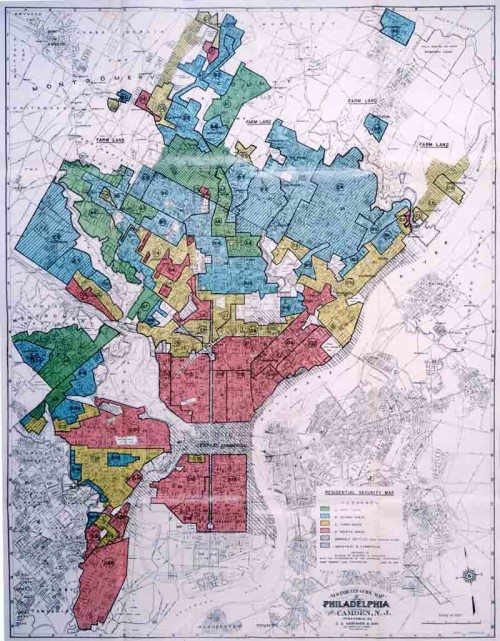

The quilt is pieced together using patterns of neighborhood blocks taken from RealtyTrac maps. Within these, foreclosed lots are shown as holes in the quilts. The lot locations are completely random and they yield an unexpected beauty when laid out on fabric. These torn holes question the protective nature of a quilt. The situation is so dire that even a quilt can’t provide the security one needs.

Clark’s artistic rendering of these maps points to the size and spread of the foreclosure problem, but also evokes the conflicting experience of home and the reality of the housing market. Homes, like quilts, promise warmth, comfort and continuity, a connection to family and a sense of protection. The holes in the quilts powerfully evoke the false promise of security offered by home ownership in the contemporary U.S.

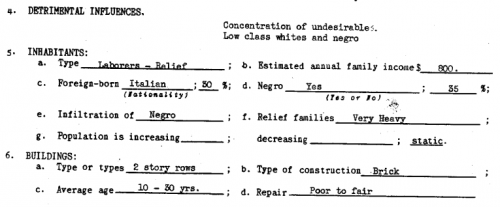

Public policy and real estate market professionals have actively worked to construct home as an owner-occupied, single family house (as opposed to rental, communal space, or other residential option). The preference for ownership has become so strong that many forgo other forms of investment for a mortgage on a house, and those who rent are told that they are “throwing their money away.” This normative belief that home ownership is the most desirable option for adults provided justification for consumers to risk their savings, even when offered poor subprime loans, because ownership is symbolically important.

The foreclosure quilts call our attention to the holes that have been produced by the collapse of the housing market. The focus on neighborhoods and blocks rather than individual houses and families encourages us to think about the impact on communities as well as individuals. These quilts offer little comfort, and hopefully provoke questions about the sustainability of our singular focus on home ownership.

For images of Clark’s quilts, check out her blog and website or an article on her work at The Atlantic Cities page.

Karen McCormack is an assistant professor of sociology at Wheaton College in Norton, Massachusetts. She is currently studying the strategies that people employ to manage the risk of losing their homes to foreclosure.